Five Star Senior Living (Nasdaq: FVE) struck a comprehensive lease restructuring and ownership agreement with Senior Housing Properties Trust (Nasdaq: SNH), in a move aimed at immediately easing Five Star’s financial woes and restoring the provider to full health in the longer term.

The deal will shift ownership of Newton, Massachusetts-based Five Star substantially to Senior Housing Properties Trust, a real estate investment trust also based in Newton, and its shareholders. The REIT anticipates making $900 million in asset sales in light of the transaction.

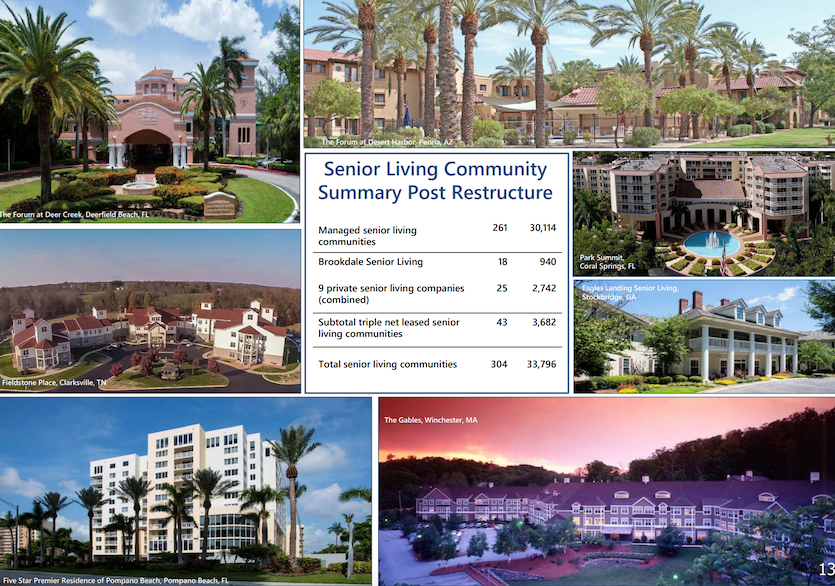

The two companies agreed to terminate the master leases, management agreements and pooling agreements for all 261 Five Star properties that real estate investment trust Senior Housing Properties Trust owns.

The current leases will be replaced with new RIDEA management agreements slated to go into effect at the beginning of 2020. In the meantime, Five Star has been granted rent reductions and a credit facility.

Those new master agreements include the following features:

- A 15-year term starting on Jan. 1, 2020, with two five-year extensions at Five Star’s option, subject to whether the portfolio maintains its financial performance

- A base management fee of 5% of gross revenues at the community level

- An incentive fee of 15% of property level EBITDA on a combined basis for the total portfolio in excess of performance targets, subject to a limit of up to 1.5% of portfolio gross annual revenue

Under the deal, Five Star sold to Senior Housing Properties Trust about $50 million in property and equipment and entered into a $25 million short-term revolving credit facility with its landlord secured by six senior living communities it owns. The interest rate under the credit facility is 6% per year on any drawn amounts, and matures on Jan. 1, 2020.

Additionally, Five Star’s monthly rent payments to Senior Housing Property Trust have been trimmed from approximately $17.4 million to $11 million. And Senior Housing Properties Trust will reduce Five Star’s indebtedness under the credit facility, assume certain liabilities of the operator or make a cash payment to Five Star in an amount that equals $75 million.

Five Star’s operational and financial woes are well-documented, and concerns have mounted as to whether the company could continue in its current state.

The company has struggled with declining occupancy rates while facing fierce competition from memory care communities, and reevaluated its skilled nursing exposure amidst declining revenue. Five Star’s stock also last year fell to a level where it risks being delisted by Nasdaq.

While it remains to be seen whether the new structure, as well as operational initiatives, will bear fruit, leaders with both Five Star and its REIT landlord expressed optimism that a path forward has now been cleared, with the specter of a potential bankruptcy no longer looming.

Switching to RIDEA

The switch to a RIDEA management structure is meant to help Senior Housing Properties Trust more actively manage and invest in the Newton, Massachusetts-based senior living operator’s real estate, according to Jennifer Francis, the REIT’s COO and President.

“Expanding the RIDEA structure gives us greater control and oversight of the real estate,” Francis said during a Tuesday morning call about the restructuring with investors and analysts. “We can take a larger role in operations and, with our size and access to capital, we can invest in and improve our communities much more than Five Star could under the prior lease structure.”

The REIT is also seeking to substantially boost its ownership stake of operator Five Star.

SNH will increase its current 8.3% ownership of Five Star to approximately 34%, effective Jan. 1, 2020 and pending shareholder approval. Senior Housing Properties Trust plans to retain this ownership of Five Star for the foreseeable future. In addition, SNH shareholders will receive common shares in Five Star, so that all told, the REIT and its investors will maintain an 85% ownership stake in the provider.

“SNH and our shareholders will own a substantial majority of Five Star after the conclusion of this transaction, enabling us both to share in Five Star’s future profitability,” Francis said. “With this transaction, Five Star will become one of the more financially stable senior living operators in the country.”

The overall deal greatly improves Five Star’s short- and long-term financial outlook, according to Katie Potter, Five Star’s president and CEO.

“I am also pleased that today’s announcement removes the cloud of uncertainty that has hung over Five Star recently,” Potter stated in a press release Tuesday. “I look forward to leading a financially strong Five Star, working to evolve our business to meet the rapidly changing preferences of older adults and repositioning Five Star as an industry leader.”

Next steps: asset sales, operational improvements

Senior Housing Properties Trust also expects to sell assets valued up to $900 million this year.

The sales will focus on standalone skilled nursing facilities (SNFs), underperforming senior living communities, medical office buildings or wellness centers and some or all of the common shares of The RMR Group it owns.

“I think we are either under agreement, or believe we’re pretty close to agreement, on the sale of about 20 [SNFs],” said Rick Siedel, Senior Housing Properties Trust’s CFO and treasurer, on the Tuesday morning call. “We are moving forward with our plan and continue to focus on private pay, but some amount of skilled nursing is key to the CCRC model.”

A large lease restructuring wasn’t the only option mulled over by the REIT. Senior Housing Property Trust’s board of trustees also weighed finding new operators, acquiring Five Star in full, selling off its entire portfolio or even letting Five Star default on its leases and declare bankruptcy.

Ultimately, though, a lease restructuring was the right move, especially as the senior living operator looks ahead with new management at the helm, following the appointment of Potter as CEO late last year. Potter and her team bring a renewed focus on operations, Francis said.

She identified some recent initiatives that have borne fruit for Five Star, including its new certifications with JD Power, a revenue management program and a push to create defined product lines by community type that is meant to help with purchasing and advertising.

On the latter point, Potter said the company was working on still defining those product lines, and would have more to say in the future.

“We have a very large and diverse portfolio and this is all about setting some standards for efficiencies – regarding design, staffing, dining standards, marketing collateral, etc.,” she said in an email to Senior Housing News. “It’s the stepping stone to clearly defining and executing brands.”

The company will also aim to further grow its ancillary businesses such as Ageility, its physical therapy company, Potter noted. Outpatient clinics recorded $9.5 million in revenues in the fourth quarter of 2018 — a 16% increase year-over-year. The organization now operates 128 clinics across the U.S.

Overall, the restructuring could have wide-ranging outcomes within Five Star and Senior Housing Properties Trust. But it’s still too early to tell whether the move might result in a good or bad outcome for the REIT and its largest senior housing operator, and the outcome largely hinges on whether market conditions improve. And while the restructuring was necessary and expected, its details did not immediately shore up confidence among investors and analysts.

“We are incrementally more cautious on the name following the announced restructuring of the FVE business relationship,” wrote RBC Capital Markets analyst Michael Carroll. “We expected and modeled this transition to occur, but the actual result is more dilutive than our prior estimate.”

Senior Housing Properties Trust also announced that it would be cutting its dividend as a result of this restructuring, to between $0.55 and $0.65 per share. Its stock fell sharply as news of the deal broke. The company’s share value declined about 15% to rest at $10.12 by the time the markets closed Tuesday.

Five Star’s stock price, meanwhile, dropped about 38% to 60 cents.

Senior housing cycle at a bottom

Although Five Star’s financial woes were dire, it’s not the only senior living operator struggling against the strong current of poor market conditions.

Brookdale Senior Living (NYSE: BKD) is in the midst of a prolonged turnaround process, while another major industry player, Capital Senior Living (NYSE: CSU) posted lackluster earnings in the fourth quarter of 2018.

Overall, Five Star and other industry stakeholders have grappled with an influx of new supply hitting certain markets in the past two years. But there are signs those headwinds could be easing up, with a possible turn toward more favorable conditions in 2020, Francis said on Tuesday’s call with investors.

“We believe that the senior living industry is at or near the bottom of the cycle and now is an opportunistic time for SNH to convert to a RIDEA structure,” Francis said. “There is evidence that supports this timing the trend of decreases and new construction starts reported by NIC over the past three quarters and recent record absorption also reported by NIC.”

Still, 2019 will continue to be a challenging year, Siedel noted.

“We do believe we’re at or near the bottom but, due to the wage pressure and some other things, we have still modeled internally 2019 to be lower than 2018,” he said.