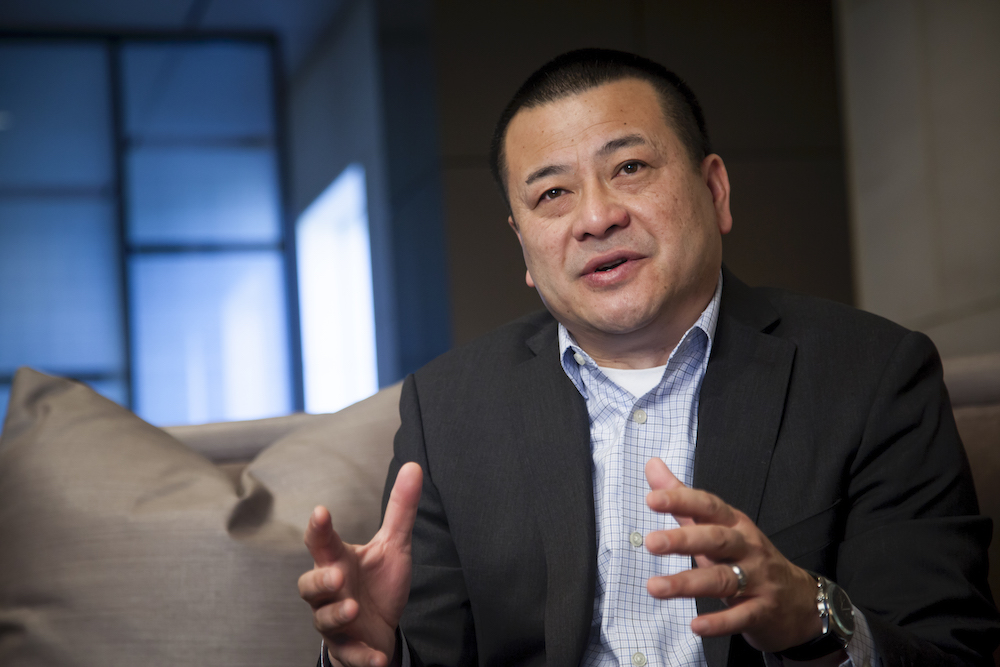

For Eclipse Senior Living CEO Kai Hsiao, the Covid-19 pandemic has proven that scale matters.

He’s been getting more calls from mom-and-pop operators under stress, thinking about how to make an exit from the industry. And he notes that providers historically have not needed to have cash reserves to handle all the costs that the pandemic has presented, from equipment to testing to hero pay.

Furthermore, scale is essential in serving the growing middle-market demographic, he emphasized. From an operating perspective, scale creates cost-saving efficiencies. From a real estate returns perspective, having larger buildings helps offset lower per-unit revenue.

“When you have scale, I think it allows you to maneuver through these types of situations a little bit better,” Hsiao said during a recent SHN+ TALKS appearance.

We are pleased to share the recording and this transcript of the SHN+ TALKS conversation with SHN+ members. Read on to learn about:

— Eclipse’s multi-brand approach to scale

— Why Hsiao believes it’s more likely that a large insurance company will acquire a senior living operator

— How Eclipse runs recruiting like a staffing agency

— Where Hsiao sees opportunities for post-pandemic growth

Lake Oswego, Oregon-based Eclipse operates a portfolio of more than 100 senior living communities across the United States. Hsiao previously held a leadership role at real estate investment trust HCP, now known as Healthpeak, and also served as CEO of independent living giant Holiday Retirement.

The following has been edited for clarity.

[00:01:52] Tim: Do you believe we’ve hit bottom in terms of COVID-related occupancy loss in senior housing?

[00:02:08] Kai: [chuckles] Wow, you jumped right into it. Okay. Probably the best way to answer that is if you just look at historical data. If you look at historical data, I think you’ll see that when cases in the U.S. are rising, you’ve seen the leads, tours, move-ins begin to dissipate, and on the flip side, when cases are going down, you see the opposite. Tours, leads and move-ins begin to increase.

With that in mind, I think we’re in a great environment right now. The cases, since the holiday period, have generally been coming down. There are some states out there that are a little hot right now, but in general, yes, cases are coming down. I think you’re seeing a lot of the leading indicators being positive, meaning leads have come back, meaning that people are out there touring again, and move-ins are coming back.

I think some of the publicly traded companies have come out and said that they had a pretty positive March there.

[00:03:12] Tim: Since you mentioned lead volume, what are you seeing? We’ve heard some companies say they’re already back to pre-pandemic levels, but I imagine a company the size of Eclipse, it might be hard to generalize. Are there regions or markets where it’s coming back faster, slower? Can you quantify what you’re seeing?

[00:03:37] Kai: Again, think you’ve seen those leads come back, and I think that’s what makes me so optimistic. The question before was, are they going to come back to pre-COVID levels? We’ve seen those in certain markets already. That’s good news there.

I think it’s proven that, I think, senior living is resilient. It’s coming back. People still need care for mom and dad. That need hasn’t gone away. People still need options of how to care for mom and dad. I think that hasn’t gone away. Yes, I think the industry has been pretty resilient.

I think the other thing to keep in mind, and I was talking to a senator about this a few weeks ago, is senior living’s very similar — and [this] sounds a little strange — but it’s like daycare. People, in order to go back to work, they need to know that they’ve got one of their most loved family members in a safe environment. That doesn’t mean just people with children, but it means people with mom or dad that they’re taking care of. Part of the drivers of senior living is the fact that people do need a place for mom and dad to be, so they can get back to work now.

[00:05:04] Tim: Looking back over the last year, it’s been a really trying time, obviously, for everyone. Did you have a low point? Was there, thinking back on COVID, rock bottom for you as the leader of Eclipse? What was this toughest moment for you?

[00:05:28] Kai: I don’t think there was one moment per se. I think there was a time, I think last summer, where COVID was impacting us, then suddenly we were dealing with wildfires here in sub markets, especially here in Oregon. Then on top of that, you had some hurricanes going on down in the South. We’re in 20 different states, so we were feeling all of that at once. There was a sense of, wow, there’s a lot going on.

It came to a point where if someone told me the zombie apocalypse were to break out, I’d be like, okay, let’s get the task force together and let’s put some protocols around that. You’ve just been through so much. I think no particular one moment. There was a lot of activity going on last year.

Now, I will also say, the flip side, with all that going on, as you reflect back, I think you realize just how strong and how great of a team we had. We were able to work through all of that and come together, everyone supporting each other. At the end of the day, we knew what our mission was, and that was to take care of our residents.

[00:06:53] Tim: I’m recalling, you also had, on top of everything else, some flesh-eating bacteria or something in the water. Was that right?

[00:07:00] Kai: There was a community that we had, I think down in Texas, where they had an issue with their water table and there was a brain-eating amoeba in the water. We went to bottled water really quickly, made sure that everyone was safe. That was, I think, on the lines of the zombie apocalypse as well.

[00:07:23] Tim: Just in terms of emergency protocols, are there things that are different now coming through all those experiences the last year, or did you find that what you had in place really seemed to work well across all these different types of crises?

[00:07:37] Kai: We, like a lot of other operators, added new skillsets. We had to use muscles that we hadn’t used before in order to make everything work.

All operators became semi logistics experts. I think all operators became experts on supply chain. I think all operators have become experts on infection control. All of those things are skillsets that we maybe didn’t have at the time, but we all got smart and we brought in additional resources to help. We all had to develop new tools and new thought processes there.

[00:08:25] Tim: I’ve asked you your low point during COVID, I guess it’s only fair if I ask, was there a moment of particular either relief where you could see the light at the end of the tunnel or something that you’re especially proud of, in terms of something that Eclipse did really well?

[00:08:42] Kai: I think people were there to support one another. I will tell you, the thing that kept me going all the time was that I think we’ve got a strong exec team, we’ve got a strong leadership team. You could throw anything at them, and they were able to address them right away.

There were no complaints. People were doing things that were outside their job description and no one pushed back and everyone was really focused on the company mission of caring for those seniors. I think when you go through tough times, I think it makes you stronger at the end. I think we’ve come out of this much stronger than that we went into it.

[00:09:33] Tim: Just in terms of where your portfolio is at today, can you walk us through that a little bit? Are there markets or regions where things are coming back faster in terms of demand and positive signs and others that are still lagging?

[00:09:50] Kai: Again, I would go back to the correlations between cases and overall demand and hotspots. Whatever markets that you see out there with those COVID hotspots are I think the same markets that we’re seeing the downturn in certain key indicators, but again, I think generally, holistically, big picture, everything is in a much better spot today than it was this time last year, for sure.

[00:10:21] Tim: Are you seeing demand come back faster for needs-based [settings] like assisted living memory care versus lower acuity type communities?

[00:10:31] Kai: It’s interesting. Again, if you take a look at the NIC data that’s out there and publicly traded company data out there, I think you can see that there’s been a difference in some of the product types.

I think CCRCs have generally held up, had been less impacted by COVID. I think that that followed by IL/AL, memory care and then the ones impacted the most have been on the skilled side in terms of occupancy. Again, I think that’s probably the broad picture I could paint for you guys on that one.

[00:11:08] Tim: When you said that there’s a correlation between COVID infection rates and the lead volume, things like that, that makes sense to me on the one hand. On the other hand, we’ve gotten the vaccine now. I imagine that makes a big difference in terms of safety in senior living communities. Is that correlation getting looser, I guess? Do you think the vaccine’s made a difference?

[00:11:35] Kai: I think the vaccines are one of the big drivers of why those cases were coming down. Right now, it’s been a race between the vaccines and the variants. As more people get the vaccines in their arms, as more vaccine doses are out there, as more people take it, I think you’ve definitely seen those cases come down, and therefore, put us in a far better environment.

[00:12:00] Tim: I know that you’ve got a mandate in place for the staff [at Eclipse to be vaccinated].

[00:12:05] Kai: That’s right.

[00:12:05] Tim: Can you just talk a little bit about decision-making around that? Some operators are doing it, some operators aren’t.

[00:12:12] Kai: For us, it was a decision that we didn’t take lightly. It boils down to two things.

One is there’s the science, and then the other one is, it’s just the mission.

On the science side, you can take a look at the data and see that, hey, look, it does help, and the efficacy is high. They had already started to [vaccinate] in other countries and it was working. From a scientific standpoint, from a data standpoint, it works. That’s one reason to do it.

The other reason is our mission, again, is to care for seniors. Our philosophy, and I say this to everyone, which is, I want us to treat every resident like they were my own mom or dad, or your own mom or dad. What type of environment would you want your mom or dad to be in? The answer there was, I want them to be in an environment where, hey, look, the propensity to possibly get COVID is as low as possible. That meant vaccinations.

There are the exceptions you have to make for religious or healthcare reasons, but no, we really believe in the fact that the mandates are going to put us in a much safer place, and that’s where I want my mom or dad to be.

[00:13:39] Tim: Have you seen attrition at all because of the mandate? People leaving their jobs?

[00:13:44] Kai: We haven’t seen it … not in droves, per se. We did provide some people some time. We said, “Hey, look, we’re going to have a mandate that takes into effect later on in June.”

That gave people time to, one, get comfortable with the fact that there is a mandate, see other people getting the vaccine, including myself and the rest of the executive team. To say, “Hey, look, there are no repercussions here, and it’s good.” I think all of that helped in setting up the stage for where we’re at right now.

[00:14:27] Tim: I talked to Mark Andrzejewski, president of MorningStar. He said that they were really surprised at MorningStar that the participation rate among their staff was so low initially. I think that has been driving some of the mandates as well. Did you see low participation out of the gate?

[00:14:54] Kai: I will say our participation rate has increased 64% since the mandate came out right [to] now. I wouldn’t say that’s all because of the mandate. I think part of that is just, again, time as more people see the positive impacts of what the vaccine does.

I can’t speak to why people say no. I think the data is there. I will say that one of the bigger challenges out there, and you really can’t get around it these days, is social media.

I think it’s surprising what you’ll find when you’re out there reading through social media and some of the things that are being said or what the chatter is out there. Again, I think our communication has been consistent. We’ve been as clear as possible in terms of why we believe that the vaccines put us in a better place.

[00:15:52] Tim: All right. We got an audience question … By way of background here, I should note that Ventas, the real estate investment trust, is I think 34% owner in Eclipse. The question from the audience is, any update on your relationship with Ventas as a committed capital partner? I know there was some talk about maybe bringing in another JV partner last year or the year before.

[00:16:25] Kai: Yes. That’s probably an update that’s better for Ventas. What I can tell you is we’ve got a great relationship, we’re aligned with them. Big props for bringing Justin Hutchens into the mix. I’ve known Justin for a long time, a good person. It’s good to have him on board.

[00:16:47] Tim: You worked with Justin at HCP, is that right?

[00:16:50] Kai: Yes, that’s right. Then, we had done some deals together when I was at Holiday. He was at NHI. A good guy.

[00:17:01] Got it. All right. Can you share Eclipse’s occupancy today?

[00:17:22] Kai: I don’t want to get in front of any earnings calls. I’ll probably pass that one for now.

[00:17:28] Tim: All right. You said leads are starting to come back. Some people are becoming less concerned about occupancy recovery, but maybe more concerned about workforce challenges. I’ll just start big picture. How do you think about workforce? How has turnover been? How has the hiring pipeline been, has anything been disrupted over the last year?

[00:17:57] Kai: I think in the workforce side it’s been interesting, because I think during COVID, I think there was a lot of talk about, hey, this may be an opportunity for senior living to capture some of the folks from other industries who were more impacted by COVID. I was one of them. I was hopeful that we could make some inroads with folks in hospitality or inroads with people in retail.

Have we done that? Yes, but probably not to the degree that we were hoping for.

I think part of the reason for that is because we’re trying to convince folks to come to the industry where I think they see some headline risk. I think that’s one thing that you’re competing against. I think the other thing you’re competing against is, there are other industries that are pretty aggressive, they’re hiring. Amazon I think is a prime example of that.

Then the other one is, frankly, I think the ROI that someone has to think through when they want to get back to work. I say that because of the benefits that are out there in terms of unemployment, in terms of some of the government funding, for some folks, it probably made sense to actually stay at home. I think all those things came into play and has put the workforce area into a very interesting place right now.

On our side, I always think of different parts of workforce. You’ve got the recruiting, you’ve got the development training side of things, you’ve got the personal development side of things. On the recruiting side, we’ve always thought of what we do as similar to a staffing agency. If I can’t staff, then I can’t provide the services that we need. We gear up our recruiting team to be like a staffing agency. We’ve been able to flex in size in order to meet the demand that we have out there.

I think the punchline here is, I think there was the hope that the workforce challenges may get a little muted because of COVID, the pull from other folks [in other industries], but again, probably not as strong as we had hoped for because of those other challenges I mentioned.

[00:20:42] Tim: It’s interesting that you draw a comparison to staffing agencies, which I feel like have a bad rap in senior living. I guess on that note, the idea that you just have to constantly be hiring and ready for that churn raises the question about turnover, which has been really high historically in senior living and it seems like a constant battle to bring it down. Do you think it’s possible to bring turnover down, or is the solution more that you have to accept that and you have to just constantly be hiring?

[00:21:14] Kai: I guess the question becomes, what are you benchmarking turnover against? In retail, turnover is higher than it is in living. In hospitality, it’s always been high there as well. I’m not quite sure what you’re benchmarking against. There are industries that are just always prone to certain level of turnover.

As an employer, do you want that? No, but it’s part of the business that you’re in. Rather than, for lack of a better word, complaining about it, you just have to make sure that you’re resourced enough to address it. Again, we think of recruiting as we think of ourselves as being our own internal staffing agency and always having the resources out there that’d be hiring consistently.

The piece I think people forget that’s different in our world than in other worlds is caregivers, people at the community, they are with residents all the time, and they see residents age in place. They form bonds and friendships with them. Seeing those residents age in place can be tough for some folks. It’s tough for me.

I remember when I started at Holiday, there was a group of Red Hat Society ladies that had met and they kept in contact with me and they would send birthday cards and whatnot. Those cards dissipated over the years because they passed. Again, I think that’s an environment that I think takes an emotional toll. It takes a special person to be in that environment. Look, it is unique to our industry, but again, I think we just need to be prepared and resource to address it rather than just complain about it.

[00:23:12] Tim: What do you consider a benchmark [for turnover]? When you said you can compare senior living to retail or hospitality and they’re different dynamics, I imagine you can also compare it to healthcare; to hospitals or other healthcare settings. Do you have a number in mind or an industry that you think is a fair comparison or that you use [to benchmark turnover]?

[00:23:34] Kai: Again, I think the numbers that you’ve seen in senior housing are the numbers, and they’ve been consistent there for a long time. If you, again, take a look at other industries, they’ve been consistent as well. Do you want to bring down turnover and increase retention? Absolutely. At the same time, you just need to be resourced to handle those levels.

[00:24:02] Tim: This is another audience question, which I think is related. How do you think senior living has done in terms of taking some of the best practices from the hospitality space, given that you come from that space?

[00:24:14] Kai: I think it’s taken some time, but I think it’s happening over time. As more people come from hospitality, as more people come from other industries, I think you’re beginning to see that perspective there. Especially at the executive ranks. I think you start seeing that pervade into senior living. Because when you think about it, a lot of senior living really came from the DNA, from a developer/operator standpoint. Then they start learning to bring in other specialties and other functions. The more we bring in from hospitality, retail, multifamily, I think you’ll see those practices start to pervade into senior living.

[00:25:11] Tim: Relatedly, this also from the audience. Coming out of COVID-19, we’ve heard a lot that it really has highlighted the healthcare aspect of senior living. Going into COVID, I think there was a lot of talk about borrowing from the hospitality industry. From my perspective, that’s gotten maybe a little muted, and there’s been louder talk now about leaning in on the healthcare side of things. Maybe with that as the background, the question from the audience is, do you think senior living can be a hospitality play and provide high levels of care?

[00:25:45] Kai: There’s always been that seesaw, healthcare or hospitality. I think during COVID, that seesaw has leaned more towards the healthcare side, especially as you see how senior living has been part of the greater healthcare system. When hospitals were overloaded with the ICU beds, that then had an impact on skilled. When we’re having low occupancy and weren’t discharging people, that had an impact on the assisted living side. We’re all part of the ecosystem. I think that became more and more clear during COVID.

That said, we’re not going to get rid of the hospitality side, because that’s one of the reasons why people choose senior living over skilled, is because there are certain services, amenities outside of healthcare that they’re looking for. I don’t see that going away. I think the need to have the hospitality touches are still going to be there. I think, during COVID, that seesaw did tilt more towards the healthcare side.

[00:26:54] Tim: I just pulled up a quote from you, that I started thinking about. It looks like at April 2019 Argentum, you said, “I think in 10 years, the biggest owner of senior living will be UnitedHealthcare or Aetna. I think insurance companies will decide to cut out the middlemen and say, ‘I know senior living providers produce better outcomes for beneficiaries, but instead of depending on someone to deliver those outcomes, I’m going to do it myself.'” Given what you just said about healthcare, do you think this scenario is more likely or less likely today than it was in 2019?

[00:27:24] Kai: I think it’s more likely. I do.

I think COVID did tilt that seesaw more into the healthcare world … As more people see that and recognize that, I think that brings more eyes onto us. The question becomes — I’m on the NIC board, and we have this discussion all the time, which is, the industry is so real estate-centric right now. That success is all built on real estate success metrics, the yields, and cap rates, and all those types of things.

I think the question becomes, does someone else who is trying to look at value-based care and how to take care of the people in their system say, “Hey, look, if I know that I can decrease costs and be more efficient, how do I go about doing that”? If that includes integrating senior living into their vertical, I think they’ll see that as a positive there. The question is going to become, how can we create the bridge between the senior living with the real estate mind right now, with the healthcare side, within the healthcare systems? That means more data, understanding what they’re looking for, and how do we produce the data that they’re looking for to say, “Hey, look, we have a case for us being beneficial to one another.”

[00:28:59] Tim: As the leader of a senior living company, it sounds like one thing you’re doing is collecting that data. Are there other things you’re doing, given that you see this coming down the pike?

[00:29:08] Kai: I think the first step is understanding, again, what they’re looking for or capturing the data that they need. I think that’s something that’s going to take some time to do that, and understand that we start capturing that data and providing that to them. Are we there as of right now? We provide 10% of the data they’re looking for, but we’ll get there because, again, I think senior living is going to be looked at as part of the bigger healthcare ecosystem.

[00:29:42] Tim: That data they’re looking for, can you provide some examples? Things like I imagine hospitalization rates of your residents.

[00:29:49] Kai: That’s right. Hospitalization rates, the cost on a daily basis. How are you preventing [resident] falls, all those type of things. At the end of the day, they want to know that, “Hey, how can I be more efficient than the options I have there right now?”

[00:30:09] Tim: There’s some providers starting their own Medicare Advantage plans. Is that something that you’ve considered?

[00:30:17] Kai: We’ve done a lot of research on it, and had some conversations with some folks who are doing it now. I have yet to see, and maybe because I’ve been too busy, I’ve yet to see a case study where we see the full positive effects. Conceptually, it makes sense to me. I would love to see the empirical data that shows that it puts you in a better place. Conceptually, I get the fact that more and more people are signing up for Medicare Advantage. It’s a doorway to a certain population.

The question is, what are the costs involved on managing them? Now, there’s some people who have said that, “Hey, look, I am going to create an organization within my organization to handle that management.” The question becomes, okay, so what’s the cost behind that and is there an ROI behind that in terms of the people that we have coming in? Or people are saying, “Hey, look, I’ll look for someone else to handle the management and the flow of that.” Is that beneficial?

I think the good news is there are a lot of people who are experimenting in it. We’ll keep looking and seeing what the results are. When one makes sense, we’ll take a shot.

[00:31:42] Tim: I guess there’s one more question on this before we move on to the new topic. When you mentioned that you think a big insurance company could be the biggest owner of senior living within a decade, is that something that the industry should fear or be concerned about?

[00:31:57] Kai: Off top my head, I don’t know why they would. Look, there are different business models out there, if you really look around the world. One of the biggest operators in senior living in China, for instance, are insurance companies because, again, they see that as a way to manage their costs. It’s not a foreign concept. It certainly works there. Look, I think there are different business models out there that could work. When you’re looking at the middle market, that might be a great way to manage that middle-market component. I don’t see any concerns with that.

[00:32:43] Tim: I guess that’s a good segue into talking about the middle market, but also broadly, I know Eclipse is pursuing a multi-brand strategy. Can you talk about the brands currently in the portfolio? This is a question from the audience. Has COVID put that strategy on hold in any way?

[00:33:04] Kai: No. When we built Eclipse — look, I had the benefit of working at Holiday before. I think I mentioned that. I had the benefit of working at [Healthpeak] before, and there were over 20-some operators that we worked with there. When we built Eclipse, we took the knowledge from all of that and said, “Look, not all seniors are created equal. They all want different things. Therefore, they’re probably different products and services they are going to want and need as well.”

When we built Eclipse, it was built with a knowledge of, we are going to have multiple brands. We didn’t slide into it. It was built with that approach because we wanted to be able to basically work with different segments out there.

Eclipse right now has — we’ve got Elmcroft, which is more of the middle market AL/memory care market. Then we’ve got Embark, which is our independent living, middle-market. Then above that, we have Evoke, which is our more high-end AL/memory care brand. Our goal is to, again, be able to sell all those three brands and populate them a little bit more, bring a little more density to all of them.

[00:34:26] Tim: Talking about that middle-market brand to start with, or brands, what’s the operating model there? Because I think that’s been obviously a huge topic of conversation. The industry has had to serve this big demographic of middle-income older adults. There is this, I think, tried and true high-end model of senior living that produces really great yields, and there is a market for that. Because staffing costs are high and fixed and there are other challenges, creating that scalable middle market product I think has been a challenge. What’s your approach to that?

[00:35:05] Kai: I think [Holiday founder] Bill Colson was probably one of the greatest innovators of approaching the middle market … I used to say that, when I was at Holiday, I’d want us to become the McDonald’s of senior living, because we could serve billions of people. That’s really about having efficiencies and doing things in a very efficient way. At Holiday at the time, breakfast or lunch that we’re serving in [different communities] is going to be very similar, the same food, the ingredients that you’re going to see. They could be used differently, but it’s the same building blocks because you’re being very efficient, you’re buying in bulk.

There are efficiencies there. I think that’s going to be one of the key ingredients as we continue to look at how do I drive costs down and keep it efficient. I think scale matters.

When we started Eclipse, we knew that because we’re dealing with a middle-market [demographic], that we needed scale … it’s a lot easier to have those efficiencies when you have the scale behind you.

[00:36:31] Tim: Just in terms of the expectations, you mentioned that the industry is real estate-driven, and investors traditionally coming to this space have expectations for a certain yield. Do you think that getting equity for the middle market product is going to be a challenge going forward? Do you think expectations have to be changed on that side about what kind of real estate returns people can get?

[00:37:00] Kai: I think scale is going to matter because while you may be making less on a per-unit basis, if you could do more units, you can certainly make up for it. You can get to the winning number, you just have to get to it in a different way. The path you take there is different. Rather than getting there with a portfolio of five assets, you may need to get there with a portfolio of 10 assets, but, again, if you’ve got the infrastructure, if you’ve got the experience and expertise to do that, then yes, you can certainly get there.

[00:37:49] Tim: For an operating margin on the middle market products, can that be in that 30% range that we see on higher-end senior living?

[00:37:59] Kai: On a per asset basis, it’s going to depend on the number of units you’re talking about and we’re going to go in with the size and scale, but yes, the holy grail would still be there. Again, you just have to play around on the expense load.

[00:38:19] Tim: You mentioned Bill Colson, which was more on the independent living side, and I think we’re seeing like Welltower, for instance, is launching a brand that’s active adult/independent living for the middle market. What about higher levels of care like assisted living for the middle market, where it seems like you do need more of that higher-paid caregiver staff. How do you provide for the middle market in that more caute level?

[00:38:45] Kai: It’s interesting you mentioned active adult. I think I’ve mentioned this before, I think active adult has been a great way to address the middle market. They probably didn’t go into it with that goal in mind, but I think it happened that way because when you’re pairing up the active adult services and combining it with maybe some outside home health or outside private duty services, you’re getting to a place where your affordability standpoint is there and you’re getting some of the lower level ADLs before you get into assisted living. I think, again, they filled that spot without maybe actively going into it trying to do that.

[00:39:34] Tim: What do you make of home care these days because we’re seeing a lot of deal-making, I think, on that side. Brookdale obviously just had this big deal with HCA for their home health line, but a lot of the franchise-based companies either are getting some health system investment or private equity investment, and we’re hearing the demand for home care is just through the roof because of COVID. I think it’s a cliche in the industry that home care is the biggest competitor for senior living. Do you think that that’s true? Are you concerned at all about the level of investment and attention that home care is getting right now?

[00:40:18] Kai: Here’s the way I view it, which is, the denominator has grown. We’ve all seen the numbers in terms of how the population of 65-plus, 75-plus, 80-plus are going to grow in the upcoming years.

There are different ways to go after and address that growing population, home health being one of them. I don’t necessarily see us as being competitors, just because, again, the denominator is so big that I think there’s enough for everybody there. In fact, I’m a little concerned there’s not going to be enough to address the demand.

Different folks will want [senior living and care] in different ways. I think the more attractive we make senior living in terms of the social side of things, I think the better for us. Some people would rather be at home by themselves and get the care that they need. Some people really do see the benefits of being in a more social environment with other folks. Look, I think there’s more than enough to go around. Let’s put it that way.

[00:41:28] Tim: I hear people hemming and hawing about the insurance companies coming into the space, and you don’t seem to be super concerned about that. I hear a lot of people hemming and hawing about home care building themselves up and digging into the market share of senior living. You don’t seem that concerned about that. Maybe my question is, what does have your concern? What do you see as the threats on the horizon for senior living going forward?

[00:41:57] Kai: It’s interesting you say that, because I think whether we like it or not, COVID has put us on the radar screen when it comes to the federal government microscope. Look, we’re one of the industries that were out there asking for government aid. That put a spotlight on us. I understand the necessity for doing that. We’re like other industries that were hurting, so we’re looking for that. Now that the spotlight is there, the question is, what’s going to happen afterwards? That’s one thing.

The other thing is, when you take a look at industries and look at our industry versus other industries, let’s say hospitality, the airline industry, whatnot, they have as an industry had been able to bring in resources, like lobbyists, like PR firms, to ensure that they’re able to communicate back to DC, in terms of what they provide, what they do with the value they bring.

One of the biggest challenges I think that the industry had at the onset of COVID was, we had to educate a lot of people in DC about all the things I just talked about. What do we do? What’s the value? People were getting us confused with skilled. People were getting us confused with the retirement homes. If you’re asking me what’s concerning me, I think there’s still a lot of education to be done there. There needs to be a lot of focus there.

If we take a look at what we’ve done so far, it pales in comparison to what other industries have done. Look, skilled got more funding than senior living did. Well, skilled also spends more than 2x, probably 3x to 4x, on public policy than senior living does. We want to be at the adults’ table, but if we want to do that, we’re going to have to resource ourselves and do what adults do, which is have that communication line with DC.

That’s going to take resources. That’s going to take people from the capital side, from the operator side, from industry partners coming together so that when we get into this situation, we don’t have to start from scratch and try to get people to help understand what we do and why we’re part of the broader healthcare system. That’s the part that concerns me right now, because you could argue that we were a bit of the forgotten ones during this process this last year.

[00:44:58] Tim: Do you think the industry would be served better if we had a single association in DC versus a handful?

[00:45:05] Kai: I think clarity of voice is important. Whenever you have multiple voices, I think you can get confusing sometimes. I don’t want to get into the politics of all that, but I think everyone can agree conceptually that clarity of voices is important there. I think AHCA has done a great job in having that singular voice for the skilled industry, and I think that’s one of the reasons why they probably saw a little bit more than senior living did.

[00:45:40] Tim: It seems to me like a big reason why it’s easier for skilled to spend money on policy-related efforts is because their revenue comes from the government. And being a private pay industry that is skittish about drawing attention to itself historically in DC, there seems to be a lot of reason to resist doing what you’re talking about. Do you think it’s going to take a crisis or something, a big regulatory package, to get people on board with this?

[00:46:12] Kai: Well, I think the crisis is COVID, and the fact that we are on the radar screen now isn’t going to go away. Let’s set skilled aside. Let’s look at other industries, whether it’d be the restaurant business, I think the dental industry, when you look at them, they got more funding than senior living did. Again, I think having a presence and having knowledge and having communication with DC is going to be important as we move forward. If not, we don’t know what’s going to happen once you get on the radar screen. Yes, you’re correct, we were trying to be under the [federal] radar screen, and I think that we saw the results that came from it.

Now that we are on the radar screen. If we don’t do anything about it, I think you’ll see the results that come from that as well.

[00:47:11] Tim: I’ve got another audience question; I know at Holiday, to backtrack, I believe you put in place a dynamic pricing system, and you’re doing something similar at Eclipse. This question from the audience says, “Price competition, have you seen increases as leads have picked up? Is Eclipse discounting? Are operators cutting base rents in addition to offering incentives, and concessions?” I guess these are questions about what you’re seeing in the marketplace in terms of pricing, and then how are you approaching pricing?

[00:47:46] Kai: From a pricing standpoint, I will say when you take a look at Eclipse, we are an amalgamation of a lot of different portfolios run by different operators. One of the things we have to do is ensure that we’re consistent on price across the board.

There were a lot of changes done at different communities so that we were standardized across the entire company. As we continue to grow, that’s what we’ll continue to do there. First and foremost is standardization for us. The hope is that once everything’s standardized, then we take the next step towards what we did at Holiday, which is dynamic pricing.

At Holiday, we were able to do that because across all 300 communities, the pricing strategy was the same. You’ve got to get that baseline down before you can start building on top of it. The good news is, we’ve got that baseline down now, and because of that, we can start in the building of that foundation. In terms of what’s going on within the rest of the industry, I think the NIC data out there has been pretty clear about that. Folks who would do mystery shops can probably say the same thing, that because of where occupancies are, I think there are folks out there who have been very aggressive on the pricing side to get that occupancy back.

No different than some other industries, multifamily has been doing that, and I think you’ll see hospitality deal with that as well. People are trying to get back to normal as quickly as possible.

[00:49:19] Tim: Just in terms of the pressures that puts on other operators that don’t want to discount as deeply, I guess I’ve heard mixed things. Some people have said that you just have to compete on price and other people are more optimistic that they can close sales by differentiating themselves on different metrics of value, but how do you approach that?

[00:49:45] Kai: I think every community is different. It’s hard to put a blanket out there. I used to always joke that when I did mystery shops, I would do something where the salesperson would lead off with, “Hey, great thing you came in today, I can give you $1,000 off the rent,” even before I gave them my name [chuckles]. You got those situations out there. There are situations where you talk to salespeople, they’re like, “Oh, so and so’s doing X, Y, and Z.” You go visit those communities, no, not really. A lot of that is chatter out there. There’s a lot to unpack when you talk about that, but I think at the end of the day, it depends on that particular community and the market that they’re in.

That’s the way you have to approach business. You can’t really do a scattershot approach on every single community when it comes to pricing. It is very specific to the supply-demand in that market, the lead flow that you have in that market. There are a lot of data points you have to take a look at.

[00:50:53] Tim: We’ve got another audience question. You mentioned a while ago that scale matters, and that’s a good quote. This is about scale. What’s the target size for an operator to be profitable?

[00:51:05] Kai: I think it depends on what types of communities that they manage. The CCRCs with 300, 400 units, certainly different than a community that has 40 units. Depends on the composition of the communities that the operator manages. The answer to that varies based on what’s underneath your umbrella.

[00:51:33] Tim: We’re seeing some operators — Discovery being, I think, a prime example — that are creating multiple brands that are based on region. Sounds like at Eclipse, you’re doing it more based on price point. How big do you think Eclipse can get, and do you think that having multiple brands enables bigger scale to still be more manageable?

[00:51:55] Kai: Yes. Maybe [we should] go back and talk about why we did the branding, because I’ve heard, “Hey, look, they did the branding so that consumers can tell the difference.” It’s a little different. I come from hospitality. I understand why branding is important in hospitality because, as a frequent traveler, you’re wanting to know exactly what is the difference, what is the experience I’m going to have at this hotel versus this other hotel? The branding helps you with that.

That’s helpful with hospitality because as a frequent traveler, I’m making that decision all the time. Now, in senior living, I’m not making that decision multiple times; hopefully, it’s just once or twice. For me, the branding isn’t so much for the consumer perspective, it’s more from an operations perspective. I know that certain regional directors of operations or certainly executive directors, they are probably most comfortable, or their skill sets are best at, a particular type of community.

A community that has a [rental rate] of let’s say $3,000 to $3,500. Now, that speaks to how you operate that community. You want the operator to fit into that. The analogy is it’ll be tough to put a general manager at a Waldorf Astoria to manage the Hilton Garden. It won’t work that way. For us, branding is more about operations, what we provide from a management skillset standpoint, not necessarily from a consumer standpoint. That’s a little bit different for us than maybe some other folks are viewing it.

[00:53:44] Tim: Got it. What can you share with us just about growth going forward, particularly in 2021? Are you looking at potential acquisitions? Are you talking to Ventas or other partners about taking on new management, maybe especially as we have been hearing about some distress situations related to the pandemic?

[00:54:08] Kai: It’s interesting because there are lots of opportunities out there. When I take a look at the phone calls that we’ve been getting, let’s say today versus maybe pre-COVID, we used to get a lot of phone calls from folks who were first-time into senior living, and they needed an operator. We’ve been getting fewer of those now than before, than pre-COVID.

We used to get calls from people saying that, “Hey, look, I’ve got an operator, but I don’t like the results. I’d like to make a change.” We’re still getting those. One set of calls a little bit fewer, another set, still about the same.

There’s some new calls that we’ve been getting recently that I find a little interesting. One is, we’re getting calls from owners who are concerned that their existing operator may not being around in 6 or 12 months because they have balance sheet issues. They’re looking for someone who has a more stable balance sheet. Those are new since COVID. I think that gives you a sense of what’s going on out there in the industry.

The last one is, they’re I think the opportunity type of investments are certainly out there more than before, for various reasons. I’ve had mom-and-pop operators call me and say they’re tired. This is more than what they thought it was going to be. They’re looking to exit and they’re looking for a friendly person to talk about what’s out there in the industry and what their exit could look like. Those conversations are a little bit more than … what they were before, in the past.

[00:55:58] Tim: I think in particular we’re hearing about the potential for hotel conversions. Is that something, especially as you’re thinking about your middle-market brand, do you think that that’s a real viable opportunity out there?

[00:56:15] Kai: It depends on the physical format of that asset. Some are a little more prone or easier to do those repositions than others. It just depends on the level of brain damage that’s required. Some may be a little bit more than others and probably other opportunities that you’d rather do instead.

[00:56:42] Tim: How much distress you think there is out there in the market? We see surveys from ASHA or NCAL, one of those groups, that said 50% of operators are worried they’re going to go under within 12 months. We’ve seen relatively few, at least that we’ve reported on, failures or bankruptcies so far. What’s going on?

[00:57:08] Kai: I think you’ve got a very — Let me back up. Senior living has always been a very fractured market in terms of, you’ve got a lot of mom-and-pop operators still who own maybe less than five communities, one or two. They probably don’t have the cash reserves. We’ve never thought of having the cash reserves to deal with something like COVID where you’ve got to go out and pay for incremental PPE, pay for incremental testing, pay for incremental hero [pay], pay those type of things.

Do I believe that they’re under stress right now? Yes. Like I said before, I’ve gotten phone calls from a lot of those mom-and-pop operators. That said, I go back to scale does help. When you have scale, I think it allows you to maneuver through these types of situations a little bit better there.

In terms of how much stress there is out there, probably better to talk to some of the folks in finance about that one. I think it will be interesting, because I think last year a lot of folks were getting deferments and a lot of the finance folks were working with folks. Then you also had government funding coming through. On the government funding side, there’s no designated dollars out of the Biden plan right now for senior living. You have to go get it from the states. We’ll see which states are the most open to that. I think that’ll be something to look at in terms of where you see those stress points down the road.

[00:58:53] Tim: Got it. Where do you feel your Eclipse is at today? I ask because I think going into COVID-19, Ventas was rebooting its senior housing [strategy]. You mentioned they brought in Justin Hutchens. I think you made a comment around that time period, that Eclipse was in the middle of turning around a big portfolio, that’s how you came to be, and you were also taking on additional turnaround communities. You had your hands full going into COVID, and then I imagine were scrambling just to respond to the pandemic. What do you need to get done that maybe you hoped to get done last year that you weren’t able to? How are you gauging where Eclipse is at versus where you hoped to be?

[00:59:48] Kai: I reflect back on the time I had that Holiday where we were trying to, I would say, build the car from the inside out. At Eclipse for the first few years, we were flying the plane while we were building the plane. I think the great news is that the plane is built. We are humming. I feel great about where we are right now. It’s exactly where we wanted to be and all the “hard work” is now done. We’ve got all the engines roaring because a lot of the work required is behind this now.

I think COVID — crossing the finish line was delayed a little bit, just because there was that higher priority there. Again, we had to build the plane. That plane is built. We are in the air, we are flying, all engines humming. I’m pretty happy about where we are right now.

[01:01:06] Tim: Great. Well, it’s top of the hour, and that’s a positive note to end on for sure. I guess I’ll just ask anything we haven’t talked about or you wanted to share, or any final messages for attendees?

[01:01:20] Kai: I just commend everyone in the industry for going through this tough year here. The great news is light at the end of the tunnel. I think the KPIs that matter are all looking positive, and I can’t wait to start seeing people in person at some of these conferences, because it’s been a while since we’ve been able to shake hands and laugh over a couple of drinks.

[01:01:49] Tim: Everyone can pencil in our next TALKS, which is on April 27th with Richard Hutchinson from Discovery Senior Living. Best of luck to everyone, until next time.

Companies featured in this article:

Eclipse Senior Living, Healthpeak Properties, Holiday Retirement, Ventas