With the senior living industry aiming for wider margins and lower expenses this year, providers across the country are getting creative on all aspects of labor as staffing remains critical albeit tough.

New data from LivingPath, an online platform that provides pricing and other data for senior housing communities, shows that senior living vacancies have decreased and wages have increased since the pandemic’s toughest days.

That is reflected in how many senior living operators have reduced agency labor as more applicants apply for open positions, and recruiting and retention becomes more important in a competitive labor market.

In 2023, senior living operators are more savvy in staffing than possibly ever before, and are increasingly using tech-enabled tools and AI in their recruiting and retention efforts.

But while the industry has made progress on staffing, some big challenges remain, from wage compression weighing on bottom-line growth to selecting qualified applicants for key care positions. Operators including Belmont Village, Goodwin Living and 12 Oaks Senior Living, Distinctive Living know that firsthand — just ask Distinctive Living CEO Joe Jedlowski.

“It’s been a mixed bag,” Jedlowski told Senior Housing News. “We’re certainly in a better position than we were a year or even four or six months ago but there’s new challenges out there.”

Care positions remain a challenge, data shows

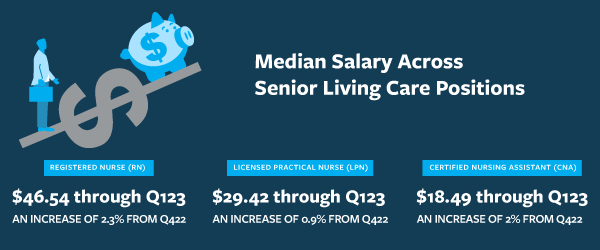

An analysis of vacancies and wage rates from LivingPath showed that vacancies for high-touch care positions and wage rates for those care positions have increased incrementally since the industry’s pandemic low points.

In a nationwide analysis of registered nurse (RN) licensed practical nurse (LPN) and certified nursing assistant (CNA) positions, LivingPath data showed that during the first quarter of this year there were 402,956 RN vacancies, 84,030 CNA vacancies and 53,570 LPN vacancies.

LivingPath’s data is based on the company’s aggregated jobs data of close to six million current U.S. job listings.

At the same time, the nationwide wage rates for those key care positions have all increased between Q422 and Q123. RN positions saw a 2.32% increase in median salary between the fourth quarter of last year and 1Q23; a 2.07% increase for CNAs; and a 0.95% increase for LPNs during that time, LivingPath data shows.

Operators that spoke with Senior Housing News said the vacancies and increased wages weren’t major surprises, and they added that staffing issues were being solved on a market-by-market basis. While these vacancies and rising wage rates are nothing new, the data paints an accurate picture of what it’s like for operators on the ground to staff their communities.

Staff vacancies across Belmont Village’s California portfolio were not a persistent problem as Belmont’s communities in Illinois have had some challenges filling nursing positions, according to Belmont Village President Mercedes Kerr.

On the ground in Illinois, Kerr said the Houston, Texas-based operator’s communities were experiencing a shortage of key nursing workers, and that burnout among existing staff exacerbated the staffing woes.

Still, Kerr said that she has seen“real progress,” on the staffing front in 2023.

“We can finally say that we’re doing better in some regards of staffing compared to a year ago,” Kerr said. “Illinois in particular has always been something where we’ve been having to work with this a little differently than in some other locations.”

Freehold, New Jersey-based Distinctive Living, meanwhile, is having a tough time filling med technician positions.

Through working to improve employee benefits and by taking an individualized, employee-by-employee approach, while implementing new technology to improve back-end operations, Distinctive has made progress in the last two years on staffing, Jedlowski said.

But new challenges are cropping up for various positions, including some that were historically easier to hire for, like housekeeping and dining services, Jedlowski said. Those positions are typically filled by younger workers and part-time retired folks by operators, and Jedlowski said Distinctive has had to use agency labor to fill some of those positions in the meantime.

While hiring might be improving, retention remains a key driver for measuring an operator’s success on staffing, and an area for many staffers to pay attention to in 2023. The problem can result in a revolving door for staffing, where an operator might hire multiple positions, but lose staff in other areas, resulting in no net gain — or even a net loss — in hiring.

“If we’re bringing up five people and we get rid of three or four people, you look and see that nothing has changed,” Jedlowski said. “So I think as an industry as a whole we are sometimes chasing our tail.”

Alexandria, Virginia-based Goodwin Living CEO Rob Liebreich said the company was seeing success hiring for LPN and CNA positions. Twelve months ago, those care positions were harder to fill.

“Every day can be a little different and we’ve been focused on RNs as an organization for some time to make sure that we’re being really attentive,” Liebreich said. “I would say that today we’re doing pretty well in that regard.”

In 2022, RN positions for Goodwin Living saw a 40% turnover rate, something Liebreich said was a catalyst to look more closely at its care positions. Nursing positions remain highly competitive across Virginia, with Goodwin Living increasing CNA pay from $13.75 per hour to $20 per hour, an effort that started in 2019.

That success on hiring is also being felt by Dallas, Texas-based 12 Oaks Senior Living. CEO Greg Puklicz told Senior Housing News the company’s hiring improved across all positions in the first quarter.

“The progression is positive each and every month,” Puklicz said. “That bodes well as we move towards stabilization. I say we’re moving towards stabilization because we’re not completely there yet.”

State-by-state data provided by LivingPath showed that in Texas –where 12 Oaks has a majority of its communities — vacancies in care positions were elevated, with 24,501 RN vacancies, 2,420 LPN vacancies and 2,899 CNA vacancies.

“It’s very situational depending on location,” Puklicz said. “Some communities are doing OK while others are suffering employee shortages more so but clearly, the shortages are in care staff.”

By conducting wage studies by position and zip code, 12 Oaks Senior Living worked with its ownership groups during budget planning to drive wage increases to remain competitive. That’s also helped the organization fill positions and not lose out on potential staff.

Recruitment and retention vital, new tech aids hiring

Operators striving for bottom line success in 2023 have taken action on staffing, ranging from bolstering recruitment to beefing up benefits and incentives for new hires and fostering work environments through leadership that reduces turnover and promotes buy-in from frontline workers.

They have done so in part through implementing new technology to increase communication or focusing on a “speed-to-lead” sales-like urgency for new staff.

Operators are also making important changes to various aspects of the hiring chain, from changing screening of prospective employees to modifying the onboarding process to improve retention.

In the last year, Belmont Village launched an artificial intelligence (AI) recruitment tool, and it works while the company’s recruitment team is out of the office.

“Over the past two years we’ve changed almost every aspect about our recruiting process so that has made a big difference,” Kerr said. “It changed so that we could be more efficient.”

Kerr said having the “recruiter in the sky” helped improve efficiency in hiring, with the technology ferrying prospective employees through the process all the way up to scheduling an interview with a hiring manager at a community.

“It’s improved our applicant flow and it’s been very useful,” Kerr added.

Kerr also noted that the company’s well-tenured staff rosters often see greater success on retention.

“It all flows downstream from there,” Kerr said. “Anytime you can have staff to help generate word-of-mouth and play into talking about the culture we have, it can have a positive impact.”

For Distinctive Living, improving its retention came through taking a one-on-one approach with staffing, to determine an employee’s career trajectory and having those important conversations with frontline staff. By personalizing the staffing issue, Jedlowski said Distinctive was able to solve specific, ancillary needs for employees that weren’t necessarily tied to a pay increase.

“In some high-barrier-to-entry markets, we’re buying bus and train passes,” Jedlowski said. “We’re taking a market-by-market, building-by-building approach for us and that’s been our mantra over the past year.”

To add efficiency, Distinctive Living implemented new technology that allows frontline staff to check-in with leadership to give direct feedback and allows for improving operations. The new platform also allows frontline workers to weigh in on their satisfaction after onboarding to give executives insights into the early stages of the hiring process.

At Goodwin Living, Liebreich said the company implemented a three-year plan to increase wage rates across various community positions to remain competitive, moving up base wage rates. To achieve this, Goodwin passed on a new monthly fee increase to residents. That increased retention across the portfolio, Liebreich added.

To aid in recruitment, Goodwin focused on its first-contact touch point with prospective employees after realizing its timeliness for responding to candidates was “pretty poor,” Liebreich said. By hiring two talent acquisition leaders, Goodwin improved its initial hiring process.

“Oftentimes we’re focused on a customer who calls and wants to get back to them quickly,” Liebreich said. “We’re taking the same mentality for new team members and we really want to be responsive and quick.”

In April, Liebreich said word-of-mouth referrals from current Goodwin team members was the “number one way” new prospective employees entered the organization.

“We’re seeing the pride grow within our team and that’s resulting in coming back to us in the form of referrals,” Liebreich said.

Goodwin employs workers from over 65 countries worldwide, Liebreich said, and the organization covers citizenship application fees, something that’s also helped boost retention.

For 12 Oaks Senior Living, the company centralized its recruiting activities and created a quicker onboarding tool. Some ways operators are innovating also comes in the form of flexible scheduling and employee-initiated pay advances through new payroll systems, something both used by 12 Oaks and Distinctive Living.

“They feel like it’s far more inclusive and in the end far more efficient for everybody,” Puklicz said.

Outlook improving, points to watch

When it comes to ways operators can move the needle on staffing, there are multiple factors that industry leaders see as critical when it comes to labor.

Kerr said that operators should focus on training new hires to get to more net hiring. After all, employees in their first 90 days are thought to be in a critical state for retention, and operators should do all they can to keep them from feeling unequipped and unsupported.

“We integrate this new workforce into what we do and we want to do it very well,” Kerr said. “Training is going to be a really key part of that because we have a lot of new people in our midst and as an industry.”

Jedlowski said the industry needed to stop “cannibalizing each other” by poaching important staffing positions, noting that there were enough applicants for all operators to succeed. That means operators must take a hunter’s approach to hiring, not just by gathering applications.

“If they’re a gatherer, they can’t work for us,” Jedlowski said. “They have to be hunters and I think that’s what would be the message I would give to other operators.”

Liebreich said operators should consider embracing the mission of providing care for older adults as a way to attract workers.

“We have to be really proud and intentional about showcasing this as a pathway, an alternative pathway that is really fruitful for folks,” Liebreich said.

For the rest of the year and into 2024, Puklicz said he believes the market will “modestly improve.”

“We have seen several months in a row where we have hired more employees than we have lost, so an overall net gain in staffing,” Puklicz added.

Companies featured in this article:

12 Oaks Senior Living, Belmont Village, Distinctive Living, Goodwin Living, LivingPath