As 2022 approaches, senior living providers are setting their annual rental rate increases — and many are going big.

I’ve heard that message repeatedly during the past week, first in sessions and conversations at the NIC conference in Houston, and then in quarterly earnings calls.

It’s a notable turnaround from this time last year, when providers were turning to rent concessions in their early efforts to rebuild occupancy lost during the pandemic.

But it’s also a shift from just a few months ago, when market conditions were different and providers generally were more hesitant to push for dramatically higher rates, the CEO of one large operator recently told SHN.

In this week’s exclusive, members-only SHN+ Update, I analyze this trend of pushing rate and offer key takeaways, including:

— why providers are confident they can increase rates more than usual

— how higher rates could more quickly sort winning and losing providers

— middle-market concerns

— the need to exercise caution, to avoid headline risk

From concessions to aggression

This time last year, senior living providers were turning to rent concessions — sometimes deep — in a bid to regain occupancy, even before Covid-19 vaccines were available.

Discounts and concessions are still being deployed across the industry today, Brookdale Senior Living CEO Cindy Baier stated last week, in the company’s Q3 earnings call. Brookdale itself deployed targeted discounts last quarter, particularly in independent living.

However, the situation is far different now than it was a year ago, Baier and other industry executives have made clear.

Baier is bullish on Brookdale’s ability to push rates, specifically annual increases for in-place residents, for three reasons:

— the 5.9% increase in Social Security payments announced last month

— steady occupancy gains

— consumers’ openness to paying more for labor-related costs

In fact, combined with occupancy growth, Baier believes that rate increases will drive revenue per available unit (RevPAR) enough to make 2022 “one of the best years in the industry’s history.”

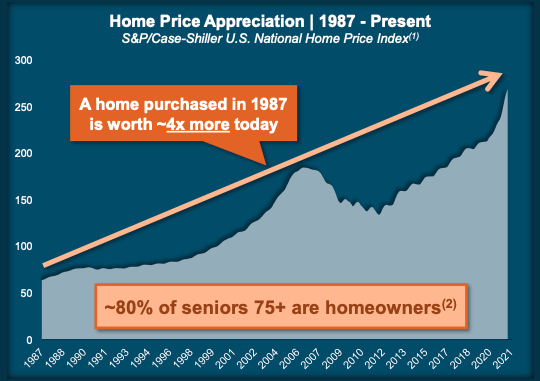

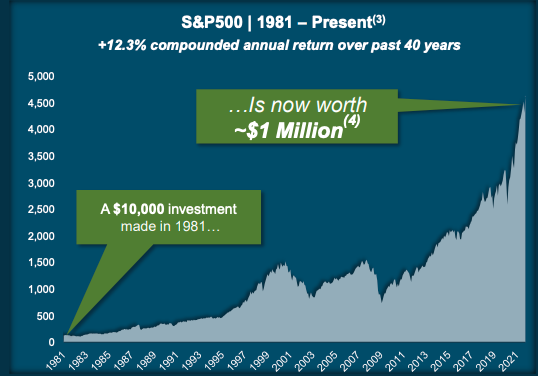

Beyond the three reasons Baier cited, other executives explained additional factors supporting strong rate increases. Welltower executives cited stock market and housing market strength, and even put out a slide illustrating consumers’ ability to pay more for senior living (see below).

Welltower CEO Shankh Mitra stopped short of throwing out a number, in terms of how much the REIT’s operating partners will increase monthly rates. But Ventas’ U.S. operators have proposed increases in the 8% range, executives said on that company’s earnings call.

Already, Ventas and Welltower have seen benefits from higher rates, which helped drive topline revenue in Q3 and compensate for spiking labor costs.

But even more dramatic benefits are yet to come, given that annual increases generally do not start to take effect until Jan. 1. Within Ventas’ same-store senior housing operating portfolio, about 55% of residents are eligible for rent increases in Q1 2022.

“There’s a huge opportunity to grow revenue,” said EVP of Senior Housing Justin Hutchens.

Sorting winners and losers

Welltower’s Mitra offered another reason why providers are able to drive rate, related to how the pandemic seems to have changed consumers’ priorities.

Now, prospective residents and their families are focused more firmly on quality of care and services and are less likely than in the past to make a decision based primarily on price, Mitra said.

One implication of this shift is that operators are boosting “street” rates for new residents at an even more rapid clip than “in-place” rates for existing residents, he observed.

But I think another implication is that stronger providers should gain an even greater advantage in the marketplace than they already enjoy.

Mitra was blunt in saying that “spectacular failures” almost certainly will keep occurring in the months ahead, given the difficult operating conditions.

Such failures will come more quickly in an aggressive rate environment where top-flight operators can charge more and still win the battle for occupancy against rivals that are less financially stable and operationally skilled.

Middle-market complications

Generally, owners and operators have sounded relieved that they are able to push rates, and they’ve also sounded understandably proud that consumers are so willing to pay premium prices for senior living, given that skeptics questioned whether Covid-19 would devastate demand.

However, I’ve heard notes of caution and concern creep into the conversation, with regard to middle-market communities.

The issue is straightforward: With incomes that are more fixed, middle-market consumers have less ability to absorb dramatic rate increases.

While I don’t know all the backstory behind the closure of Eclipse Senior Living, I think it stands to reason that the operator was more hamstrung on rates than some others, because the communities served a more mid-market demographic.

And I also think it stands to reason that Eclipse and Enlivant — another provider serving the middle market — both turned to dynamic pricing systems in an effort to set the most competitive rates possible. The continued refinement of dynamic pricing or other data-driven pricing approaches could be helpful to creating a sustainable middle-market model, and Welltower’s efforts to harness data analytics in rate-setting could be a step in this direction.

Longer term, operators are also looking to leverage technology or find other ways to lessen labor costs in middle-market operating models, to provide more breathing room on the margin even if rates cannot be pushed.

But for the moment, investors may simply have to accept a lower return for middle-market communities versus market rate or luxury properties, given that expenses are climbing and rates can only move so much, Brian Sunday, managing director with private equity firm AEW, said at NIC.

Caution needed

In just about all the recent conversations related to rate hikes, executives have emphasized the need to be transparent with residents about why prices are going up, and they have said that residents want to ensure staff stability even if that means higher rents.

I’m not surprised that residents are generally accepting of rising rates; inflation and labor pressures are palpable across the economy, so it’s easy for people to see why their senior living bills might also be going up.

However, it’s also far too easy to imagine news segments and articles accusing senior living providers of greedily hiking rates 10% and demanding that “grandma” hand over her extra Social Security dollars, when she is already paying $6,000 a month and caregivers are struggling to get by on their wages.

Providers can protest about how such coverage paints an unfair and incomplete picture, but such rebuttals can only undo so much damage after such pieces have already been printed or aired.

So, I hope that providers are not just paying lip-service to being transparent with residents, but are doing everything possible to gain widespread buy-in for higher rates. Working with PR professionals to craft the letters and other materials explaining the rate hikes seems like a wise move to me, as well as taking steps to show how the additional funds are supporting the workforce.

Otherwise, providers risk taking a step backward in public perception even as they move toward financial recovery.

Companies featured in this article:

AEW Capital Management, Brookdale, Eclipse Senior Living, Enlivant, Ventas, Welltower