Five Star Senior Living (Nasdaq: FVE) is a leaner company today thanks to its plan with Diversified Healthcare Trust (Nasdaq: DHC) to transition 108 communities to new operators. But that is only the beginning of a larger metamorphosis taking place within the company, according to Five Star CEO Katie Potter.

“This important first phase of our transformation will support improved operations as we focus on a core service offering and capitalize on a growing target demographic,” Potter said during the company’s second-quarter 2021 earnings Thursday.

Through a three-pronged strategy, the Newton, Massachusetts-based company is seeking to “evolve” and “diversify” its service offerings. The first part of that plan is to optimize Five Star’s portfolio as it works with Diversified Healthcare Trust to transition more of the 108 communities to other regional operators.

Diversified Healthcare Trust has so far entered into agreements to swap operators for 76 of the 108 communities slated for management change with Five Star.

The operators on board to take over some of the 108 communities currently include Charter Senior Living, which is managing the properties in Florida, Maryland, Tennessee and Virginia; Phoenix Senior Living, which is managing communities throughout the Southeast; Oaks/CaraVita Senior Care, an existing tenant in Diversified’s portfolio managing communities in Georgia and South Carolina; and Stellar Senior Living, another prior tenant that is managing 10 communities in Colorado, Texas and Wyoming.

As of Thursday’s earnings call, Five Star had officially transferred management of 41 communities and also closed nearly 1,500 skilled nursing units in the continuing care retirement communities (CCRCs) it manages for Diversified, with plans to eventually reposition them to other uses, such as memory care.

The move is notable for Five Star and Diversified, which have long been linked through an affiliation with alternative asset management company The RMR Group.

Five Star logged a net loss of $12.3 million for the second quarter of 2021. The operator’s share price fell nearly 11% Thursday, landing at $4.63 by the time the markets closed.

Road to reinvention

Five Star’s ultimate goal with its strategic transformation is to retool its service offerings to better meet the demands of the incoming generation of older adults. The first step of that plan — currently underway — is to reposition its senior living communities to focus on larger blended assisted living, independent living and memory care communities as well as standalone active adult and independent living communities.

Five Star has already finished one other part of its strategic plan by exiting the skilled nursing industry, which was effectively complete as of the end of the second quarter. And now Diversified and Five Star are working to sell more than 500 skilled nursing bed licenses in those communities, Diversified’s CFO and treasurer, Richard Siedel, said on the real estate investment trust’s (REIT) second-quarter earnings call Thursday.

While the details are still in flux, Siedel shared some details on what the future might hold for those units.

“In a lot of cases, it will likely be a higher-acuity memory care-type product,” he said. “All the other business lines are less expensive to operate and less regulated than the skilled nursing space is, so we’re pleased to see that reduction.”

While exiting skilled nursing also means the closure of all of Five Star’s inpatient Ageility rehab clinics, the operator is holding onto the service line and seeking to grow it in other ways. For instance, the operator opened three new Ageility outpatient clinics in the second quarter, and is branching out into fitness and personal training offerings to complement its outpatient therapy and home health services.

“We expect to continue to expand our Ageility footprint and have experienced additional growth from our agility fitness offerings,” Five Star’s Potter said. “While still comprising only a small portion of our overall business, fitness revenues have increased by more than 50% over the past year.”

The 120 communities remaining in Five Star’s portfolio with Diversified Healthcare Trust are stronger performers than others in the managed portfolio, with 340 basis points higher average occupancy and 270 basis points higher operating margin than the communities in the total managed portfolio, according to Potter. As of July 31, those 120 communities had added 140 basis points of occupancy from their pandemic lows to 73.8%, according to Five Star.

That progress is fueled in part by the fact that Covid-19 cases have remained low since vaccines were rolled out earlier this year. The company has since also mandated that employees have to get vaccinated for the coronavirus by Sept. 1.

Aside from repositioning its portfolio, Five Star has set a goal to evolve the company and its service offerings. The operator plans to achieve that through a new shared service center supporting operations and growth; by developing new and differentiated resident experiences; and through home health and concierge services.

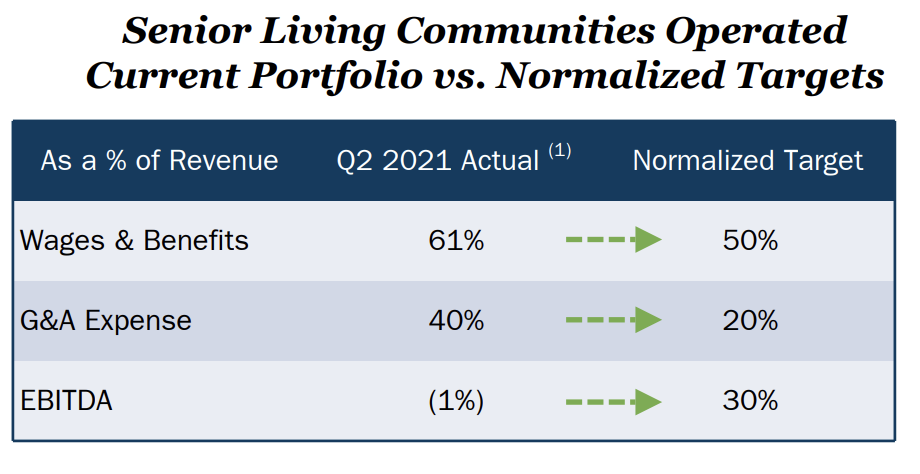

Five Star is also “right-sizing” its corporate general and administrative expenses over the next several quarters as it works through its community and Ageility clinic transitions.

The last component to the company’s strategic business plan is to diversify its service offerings — something it is already doing by launching fitness and other concierge services.

Once all these pieces are in place, Five Star’s leaders believe the company will be well-positioned to grow in the post-Covid period.

“As we move through the phases of our strategic plan, we will continue to prioritize the evolution of our differentiated resident experience to meet market demand and opportunity, as well as the diversification of our services offering and customer base to drive future revenue growth,” Potter said.