Ventas (NYSE: VTR) is acquiring New Senior Investment Group (NYSE: SNR).

The Chicago-based real estate investment trust announced on Monday it had entered into a definitive merger agreement to acquire New Senior in an all-stock transaction. The deal with New York City-based New Senior is valued at $2.3 billion and includes $1.5 billion in New Senior debt.

Under the terms of the agreement, New Senior shareholders are slated to get nearly 0.16 shares of Ventas stock per share of New Senior common stock. The transaction valuation represents an approximately 6% capitalization rate on New Senior’s expected 2022 net operating income (NOI), and Ventas expects it will add approximately 9 cents to 11 cents to the real estate investment trust’s (REIT’s) normalized funds from operations.

This announcement comes one week after the news that New Senior’s two primary operating partners — Atria Senior Living and Holiday Retirement — are combining. Ventas owns a 34% stake in Atria.

“The transaction provides Ventas shareholders with an attractive valuation and accretion, and further positions us to win the recovery,” Ventas CEO and Chairman Debra Cafaro said in a press release. “It continues Ventas’s longstanding track record of capital allocation excellence, builds on our deep experience with the independent living product and leading operators Atria and Holiday, and is a testament to the continued dedication and expertise of our outstanding team.”

New Senior has 102 private-pay independent living communities and one continuing care retirement community (CCRC) in 36 states. The portfolio carried approximately 40% operating margins before the pandemic, according to Ventas.

The acquisition price implies a 20% to 30% discount to estimated replacement cost per unit, according to Ventas.

The deal’s strategic and financial benefits include the fact that New Senior is in the early stages of its post-pandemic recovery. New Senior’s same-store occupancy gains “accelerated in June,” and spot occupancy gains are expected at the high end of the company’s 2Q21 guidance range of 120 to 150 basis points, according to Ventas.

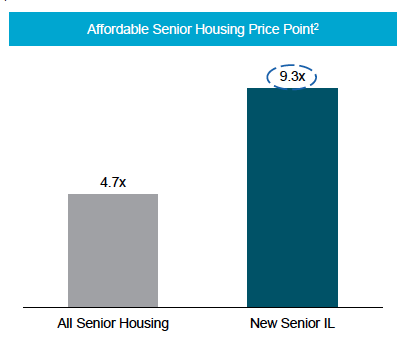

Furthermore, the transaction increases Ventas’ exposure to senior living communities at a middle-market price point, with demand set to surge from this demographic group. New Senior’s independent living communities have an average revenue per occupied room (RevPOR) of about $2,700. The portfolio has an “affordability coverage” — average resident household value to annual rent — that is higher than industry norms.

Though Ventas foresees some “limited near-term capital expenditure needs,” the New Senior portfolio caters to the independent living demographic with “attractive physical characteristics, including large, well-designed floor plans.” The communities are also located in submarkets with advantaged median home values exceeding $300,000 and median incomes exceeding $70,000.

The deal also bolster’s Ventas’ relationship with some of its operating partners, and establishes new ones. Of the 103 properties, 65 are managed by Holiday; 21 are managed by Atria; and 16 are managed by other senior housing operators, including Grace Management, Merrill Gardens Senior Living, Hawthorn Senior Living and Watermark Retirement Communities.

By combining with New Senior, Ventas expects to see $16 to $18 million in “annualized corporate G&A synergies” starting in 2022.

Centerview Partners is serving as financial advisor for Ventas on the deal, while Wachtell, Lipton, Rosen & Katz is acting as legal advisor. Morgan Stanley & Co. is serving as financial advisor for New Senior, and Cravath, Swaine & Moore LLP is acting as the company’s legal advisor.

Analyst reactions

BMO Capital Markets analysts Juan Sanabria and John Kim “viewed the transaction positively” in their investor note Monday.

“SNR adds earnings upside near the [senior housing] trough via a middle-market, independent living portfolio at an attractive yield (~6% in ’22) at a discount to replacement cost,” the June 28 note from Sanabria and Kim reads. “At current valuation levels, we believe VTR needs to continue to execute on external acquisitions.”

Daniel Bernstein, director and senior REIT analyst at Capital One, told SHN that the transaction reminded him of “the early days of 2001 to 2007, or 2010 to 2015,” when health care REITs became more active buyers of properties.

“Along with intense private equity interest, we could begin to see increasing scarcity premiums for large portfolios with high-quality operators,” he said.

Last week, in conjunction with Atria’s acquisition of the Holiday management business, REIT Welltower (NYSE: WELL) acquired 86 self-managed Holiday properties for about $1.6 billion. That price represented about $152,000 per unit, compared with a per-unit price of about $181,000 per unit for Ventas’ acquisition, analysts from Stifel stated in a note issued Monday.

“We think the pricing difference reflects partly the takeout premium of SNR and partly the quality of assets,” the analysts noted.

The “public nature of VTR’s bid” might also have driven the pricing higher than Welltower, BMO’s analysts surmised.

Ventas’ senior housing operating portfolio (SHOP) exposure increased to 31% with the transaction, and the REIT should look forward to additional income from its 34% ownership stake in Atria, the Stifel team observed.

“Atria/Holiday will be the second largest senior housing operator, and could see additional consolidation opportunities — and VTR should gain additional benefits through its 34% stake in Atria,” their note reads. “Ventas expects total NOI to bounce back to $138M in 2022, roughly the same level as FY2020.”

Ventas stock was down a slight 0.53%, trading at $58.01 when the market closed on Monday. New Senior shares were up 28.72%, trading at $8.92 per share.