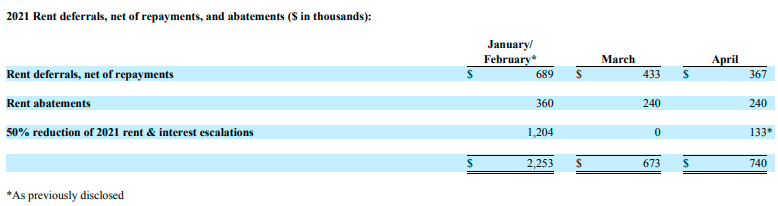

LTC Properties (NYSE: LTC) granted roughly $3.7 million in deferred, abated and reduced rent in the first four months of this year. The Westlake Village, California-based real estate investment trust (REIT) also has agreed to provide rent deferrals and abatements of up to $721,000 for both May and June of this year.

In Dec. 2020, LTC offered a 50% reduction in rent escalators to its operators, which is reflected in its Q1 2021 numbers.

And, the REIT is moving forward with its plans to transition its 23-property Senior Lifestyle Corp. portfolio, according to a business update that LTC issued Monday.

Chicago-based Senior Lifestyle has not paid rent to LTC in 2021. The current minimum monthly rent due to LTC from Senior Lifestyle, not counting rent received from re-leased properties, is $1.1 million.

During LTC’s Q4 2020 earnings call, executives with the REIT said that 11 Senior Lifestyle properties already had been transitioned to other operators, and they shared plans to transfer, sell or otherwise address the other Senior Lifestyle properties in the portfolio. The operator had fallen behind on rent in the midst of the Covid-19 pandemic.

By the end of Q2 2021, four more Senior Lifestyle properties likely will go to new operators and three are expected to be sold, according to Monday’s update. One community is slated to be transferred to a new operator by the end of July, one has been closed and will be sold for an alternative use.

“Options are currently being evaluated for the last three,” the REIT stated.

LTC also provided an update on skilled nursing tenant Abri Health Services and Senior Care Centers.

Senior Care Centers filed for bankruptcy in 2018 and emerged from bankruptcy in March 2020. Abri was formed as the parent company of the reorganized enterprise and became a co-tenant and co-obligator under LTC’s master lease.

On April 16, 2021, Abri and Senior Care Centers again filed for Chapter 11, as LTC was already in the process of transitioning the communities to HMG Healthcare. Abri/Senior Care operate 11 skilled nursing centers under the LTC master lease; the REIT has not received rent since Feb. 2021.

LTC has sent a notice of default and a notice of termination of the master lease, effective April 17, 2021. The current minimum amount owed by Abri/Senior Care is $1.2 million.

LTC’s update comes on the heels of a disclosure that Murfreesboro, Tennessee-based National Health Investors (NYSE: NHI) is extending rent deferrals to its tenant Bickford Senior Living.

Senior housing analysts anticipated rent support in 2021, as operators continue to feel the effects of the Covid-19 pandemic. The good news is that occupancy loss appears to be slowing and perhaps stabilizing, with forward indicators like lead volume turning positive.