Senior living occupancy rates have reached a new low as pressures from the Covid-19 pandemic continue.

Furthermore, the number of senior living operators with occupancy rates below the market average grew in 2020. But the prospect of a vaccine on the horizon offers a glimmer of hope for the coming year.

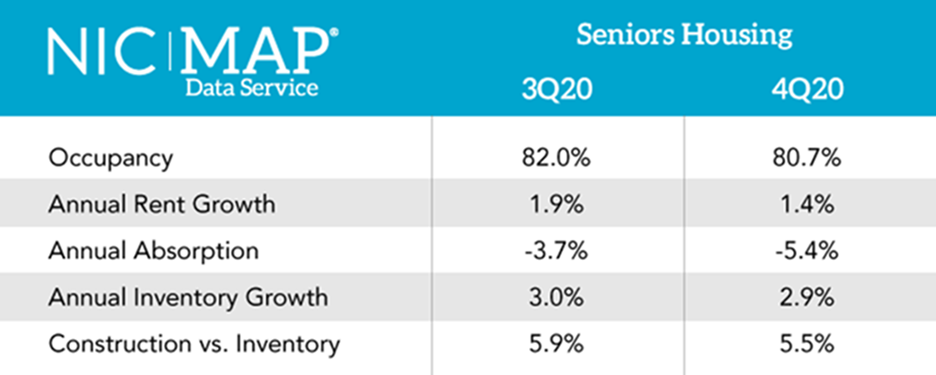

U.S. senior housing occupancy dropped another 1.3 percentage points, going from 82% in the third quarter of 2020 to 80.7% in the fourth quarter, according to the NIC Map Data Service, which is provided by the National Investment Center for Seniors Housing & Care (NIC).

4Q20 NIC MAP Data Market Fundamentals

4Q20 NIC MAP Data Market FundamentalsOverall, occupancy decreased by 6.8 percentage points since the first quarter of 2020 — and as expected, much of that has to do with the pressures of the Covid-19 pandemic, according to NIC Chief Economist Beth Burnham Mace.

“The pandemic is definitely continuing to take a toll on the sector,” Mace told Senior Housing News. “And we’re seeing that through the occupancy rates that have fallen for nursing care, assisted living and independent living.”

Occupancy slides further

The number of providers with high occupancy rates slipped in 2020, according to Mace. Among NIC’S 31 primary markets, 11% of operators had occupancy rates above 95% in the fourth quarter of 2020 — a decrease from the second quarter last year, when 22% of operators in those markets had average occupancy rates above 95%.

Meanwhile, the number of senior living operators with occupancy rates below the market average of roughly 80% grew in 2020, going from 29% in the second quarter of 2020 to 40% in the fourth quarter of last year.

“There is still inventory coming into the market, and there are still new projects that came online in the last couple quarters,” Mace said. “So, that’s pulling that share below 80% down.”

Industry-wide average assisted living occupancy dropped 1.3 percentage points to 77.7% in the fourth quarter of 2020, while independent living occupancy dropped 1.4 percentage points to land at 83.5% during the same period. Overall, assisted living and independent living occupancy rates have dropped by 7.4 and 6.2 percentage points, respectively, since March of last year.

The good news for providers is that the rate of occupancy declines slowed in the fourth quarter compared with the second and third quarters of 2020. Assisted living occupancy rates declined 3.2% and 3% in the second and third quarters, respectively, while independent living occupancy dropped 2.5% and 2.3% in the second and third quarters, respectively, Mace said.

The fact that occupancy declines slowed as the year went on illustrate how some senior living providers have gotten a better handle on Covid-19 since the pandemic began.

“I think there’s a lot of lessons learned, and that’s probably helping,” Mace said. “There had been some self-imposed moratoriums on move-ins early on in the pandemic, and while there are still some of those in place, I think there are better strategies in place now and that’s helping to support occupancy.”

The occupancy declines also differed from market to market. For example, San Jose, San Francisco and Seattle had the highest average occupancy rates in the U.S. at 88.5%, 86.9% and 84.8%, respectively. Meanwhile, Houston, Cleveland and Miami sat at the bottom of the pile, with average occupancy rates of 73.5%, 76.6% and 76.7%, respectively.

“Some of that had to do with the supply considerations, and there’s still supply coming in some of these markets [such as Houston and Miami],” Mace said. “As opposed to markets on the opposite side, like San Jose or San Francisco, which haven’t had the same equation.”

The road ahead

Although there is light at the end of the tunnel for the senior living industry in the form of the Covid-19 vaccine, many senior living providers will still face a tough year in 2021.

For one, Covid-19 outbreaks are still surging across the country, and that will continue to pressure the industry for the foreseeable future, Mace said. The industry’s vaccine rollout is another potential hazard in 2021, as providers will need to win the trust of their residents and staff in the face of widespread and growing misinformation.

So far, vaccination efforts are moving ahead as planned, according to the American Health Care Association and National Center for Assisted Living (AHCA/NCAL), which represents more than 14,000 nursing homes and assisted living communities across the U.S. But it may take the first half of 2021 before the U.S. makes real headway on vaccinating enough people to resume more normal life, Mace said.

For senior living operators, heightened safety protocols, plus financial pressures that are still squeezing margins, will make 2021 tough to navigate. But beyond that, the vaccine represents a “light at the end of the tunnel” for the industry, according to Mace.

“The bottom line is that 2021 will be a challenging year for senior housing operators,” Mace said. “But [as more vaccines are administered], you should see a pretty good pickup by the end of 2021 … and then 2022 should start to improve further from that, barring any other disasters.”