Middle Market Done Right:

Strategies and Solutions from Senior Living Providers

The senior living industry has historically provided two product types at opposite ends of the financial spectrum. At the top is a private-pay product that can command high monthly rates for rents and services. At the bottom, government subsidized housing is available for low-income seniors who qualify for housing waivers, Medicaid benefits and other programs.

This leaves a vast number of seniors out of the mix: the middle market. This report defines the market, describes the challenges and identifies senior housing providers that are getting it right.

DEFINING THE MIDDLE MARKET

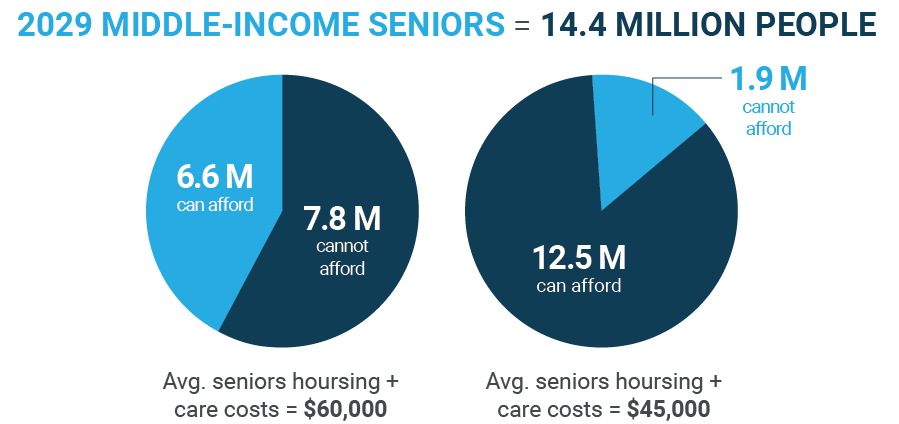

A massive opportunity — for creative operators

Trends in demographics, economics and health should continue to push the middle-market need higher in the early part of the 2020s. A study in May of 2019, led by the National Investment Center for Seniors Housing & Care (NIC) and NORC at the University of Chicago, laid out in plain detail just how high that need will be. By 2029, there will be 14.4 million middle-income older adults in the United States, and market-rate senior living will be unaffordable for 54% of them.[

That is 7.7 million seniors between the ages of 75 and 84 who don’t qualify for government assistance but will still likely reach a point where they cannot safely live in their existing homes.

To put it another way, in 2029 there will be nearly as many U.S. seniors who can’t afford market-rate senior living as there are residents in all of New York City. But the NIC/NORC study offers a mathematical solution along with its forecast.

A product that trims average resident expenses by $10,000 to $15,000 annually could make senior housing affordable for another 2.3 million to 5.9 million older adults.

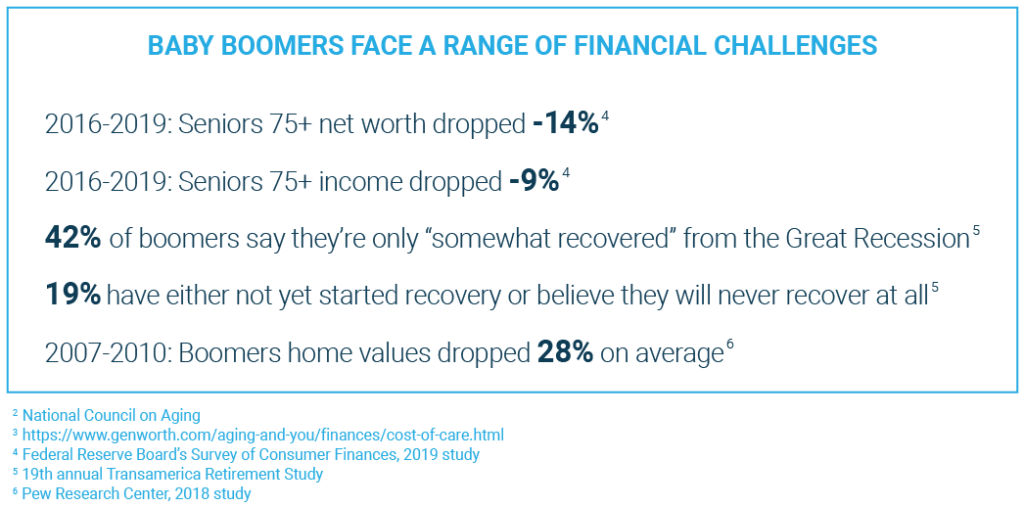

WHY THE MIDDLE-INCOME SENIOR IS IN TROUBLE

The financial challenges that tell the tale

Simply put, the need for middle-market senior living is massive, as many baby boomers find themselves entering retirement with fewer financial resources than they may have expected a decade ago.

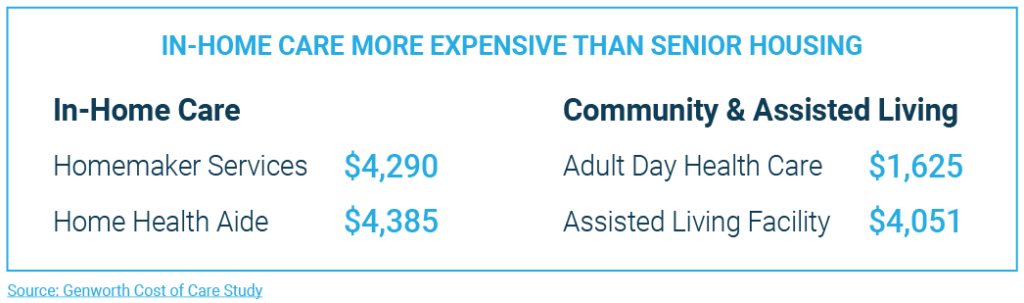

The most pressing challenge comes from care costs, largely from chronic disease management, which affects 80% of older adults according to the National Council on Aging.

The monthly median cost of care for homemaker services in 2019 was $4,290, or about $240 more than the same care in an assisted living facility. If seniors cannot afford to bring care into the home, they must find a safe, affordable alternative outside of it.

These factors — demographics, economics and health — mean a higher volume of seniors than ever are in need of housing where they can age in place and manage their health in an affordable way.

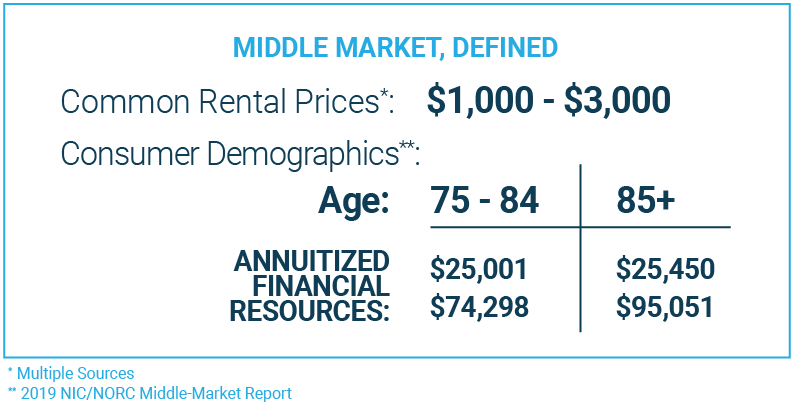

MIDDLE-MARKET, DEFINED:

Price points and consumer demographics

While many operators are seeking an entry point to this expanding segment of senior living, the key challenge they face is how to meet resident lifestyle, health care and cost-of-living needs at a workable margin.

The middle-market segment of senior living is often defined by what it is not — it is not part of the Low-Income Housing Tax Credit (LIHTC) program, and it is not luxury.

The most common low-end figure for middle-market rent is about $1,000 per month. At most, middle-market rents are estimated at $3,000 per month.

MEET THE OPERATORS

Pioneering middle-market strategies, and the creative operators leading the way

Middle-market senior living is an evolving product, still being defined and redefined by those who are paving the way to create it. In a way, that makes it an easy product to understand, as ultimately it is defined by the problem it looks to solve.

Operators today employ a range of models to help middle-income seniors solve that problem. Here is a look at some of the cutting edge strategies for cracking today’s middle-market conundrum, and the pioneering operators leading the way.

OPERATOR: Clover Management

Middle-Market Strategy: Minimize development costs and leverage partnerships to reduce resident care expenses

With 35 occupied middle-market communities across four states, and another 12 projects in the works, the New York-based Clover Management has developed a scalable model for middle-market development that founder and president Michael Joseph believes can now work in a variety of metro areas.

Clover middle-market buildings are 2-3 stories at about 125 units. Buildings include large community spaces such as coffee bars with spacious entryways, all built in metro areas near cities such as Buffalo, New York and Scranton, Pennsylvania. But Joseph is targeting future sites near larger cities. Careful site selection and a vertically integrated development, construction and operating business enable Clover to consistently operate within a tight margin.

Backed by capital partners The Carlyle Group and Welltower, Clover targets older adults who rely on savings, Social Security and a small retirement pension; monthly rents range from $1,000 to $1,200, with no meal or care component as part of those rates. This creates a product that Joseph calls “true independent living.”

Welltower’s $343 million purchase of a Clover middle-market portfolio of 32 communities in Q3 2019 led to another cost-saving effort in the REIT’s work with Geisinger health system. That partnership brings health resources to Clover residents, including through participation in Medicare Advantage plans, as well as access to special health and wellness centers that Geisinger calls its “65 Forward” program.

OPERATOR: SHAG

Middle-Market Strategy: Control costs through health care partnerships and reduced amenities

SHAG (Sustainable Housing for Aging Generations) has built a portfolio of age-restricted housing properties in the state of Washington addressing the middle market through a mix of affordable housing development and reduced market-rate housing. The organization also has created partnerships with health care programs, provider networks and insurance carriers, all of which bring a range of proactive, preventative health services to residents, at lower costs.

SHAG also limits costs of both labor and activities by reducing amenities and encouraging residents to take on a DIY approach to their senior living lifestyle. That means developing properties in areas where community partnerships are feasible.

To meet these goals, SHAG develops based on market conditions, looking for areas where renters can afford prices at 50% to 60% of the annual median income. The company also uses higher unit counts to create additional efficiencies of scale, with an average sweet spot of about 250 units, though buildings go as high as 450.

OPERATOR: Greystar

Middle-Market Strategy: Follow the active adult rental model to reduce cost while creating a sense of community for residents

Those who are following the ongoing industry debate about how to define active adult housing know how nebulous senior living labels can be when examining emerging products. But it is this ongoing debate — and the active adult rental product itself — that lends understanding to the middle market problem and its varied solutions.

The simplest definition of active adult housing — also known as “55+” — is senior housing that lacks a care component. It typically does not bring any services into the home, and requires from residents a DIY spirit. Active adult residents skew younger and healthier than independent living residents, and are driven to the product largely for lifestyle reasons. As a result of its configuration and service offering, active adult also saves on labor cost compared to care-continuum senior housing, a key element in the industry’s pursuit of a sustainable middle-market product.

Some of the principles used in active adult might be beneficial for solving the middle-market senior housing crisis, because even though based on strict care-continuum definitions active adult is not senior housing, it still addresses a senior housing need, something that Greystar Real Estate Partners knows all too well.

The Charleston, South Carolina-based multifamily operator is one of the biggest players in active adult apartment rentals, with 43 communities across the United States under its Overture brand, and it is now directly targeting the middle-market senior living consumer with a new product dubbed Album, which rents at 25% lower than its other brands.

Greystar’s methods for keeping costs down include smaller amenity spaces, and development in less dense and more suburban locations that offer walkability and resident-led activity options. The company executes intense psychographic research to identify consumers, and one of its driving principles is that these residents are motivated by an active adult lifestyle and a shared sense of community.

Greystar has responded by taking advantage of several major senior housing trends, including mixed-use development, intergenerational living and urban building.

OPERATOR: Priya Living

Middle-Market Strategy: Change amenities and lifestyle services to a la carte

A lower-cost product requires cost cuts as well as efficiencies, and some operators are doing so by saving on two senior living standards: dining and activities. San Francisco-based operator Priya Living has three communities, all in California, and its model is based on a la carte, on-demand services for independent residents.

As needed, and on demand, Priya residents use an app to order meals, housekeeping, laundry services and transportation. Residents can also go through Priya’s community directors to order personal care services. They are billed at the end of the month.

Interestingly, Priya has found creative ways to recreate certain key benefits to some services, while doing so at a lower cost. Take dining, for instance. Senior housing residents love their dining programs, but dining is expensive, including due to the high labor needs.

Instead, Priya has a service that provides in-unit, short-stint personal cooks for $20 an hour. It has group cooking offerings for friends to gather. And it has a partnership with “cloud kitchen” service Shef, where Priya residents can have pre-packaged meals delivered for $8 to $10 apiece.

THE FUTURE OF MIDDLE MARKET DEVELOPMENT

The need for middle-market senior living has never been greater. Operators should not get bogged down by terminology; if a product solves the middle-market conundrum, it is middle-market senior living, no matter the name.

Of course, the solutions above are best for low-acuity residents, or even no-acuity residents. The next frontier in middle market is creating that lower-cost product at the higher acuity levels, something Gardant is striving to do (see below).

No matter the format, operators with creative, strategic approaches to reducing cost while continuing to meet resident needs will find themselves at the forefront of a burgeoning opportunity over the next decade.

FIVE ADDITIONAL OPERATORS TO WATCH

- R.D. Merrill Company: Create a feeling of senior living as an “extended stay hotel” with fewer amenities, along with a universalized staff that optimizes hiring

- Eclipse and Pathway to Living: Use a multi-brand strategy a la hotel chains to create products at different price points that can reduce cost in part by leveraging back-office efficiencies

- Benchmark: Shared common spaces; mixed-use and urban planning; middle-market branding as The Branches

- Gardant: Create affordable living through Medicaid waivers

ADDITIONAL READING AND RESOURCES, SENIOR HOUSING NEWS

- Senior Housing News trends reports

- The SHN Multi-Brand Strategies Report

- The SHN Mixed-Use Development Report

- The SHN Onsite Primary Care report

ADDITIONAL READING AND RESOURCES, OTHER

- Middle Market resources, from NIC

- 19th annual Transamerica Retirement Study