Senior living providers are spending much more on technology during Covid-19, even if many of them are also not sure what they’ll do with it in the future.

Those are among the findings of a new survey conducted by Senior Housing News in partnership with global health technology firm Philips. The survey — conducted online from July 30 to Aug. 17 — contains responses from more than 250 members of the Senior Housing News audience.

According to the survey, 80% of respondents reported an increase in tech spending this year to help address the Covid-19 pandemic. And looking ahead, 87% said they expect their organizations to increase their technology budgets in 2021, spending more on items such as resident monitoring, contact tracing, telehealth and virtual tours.

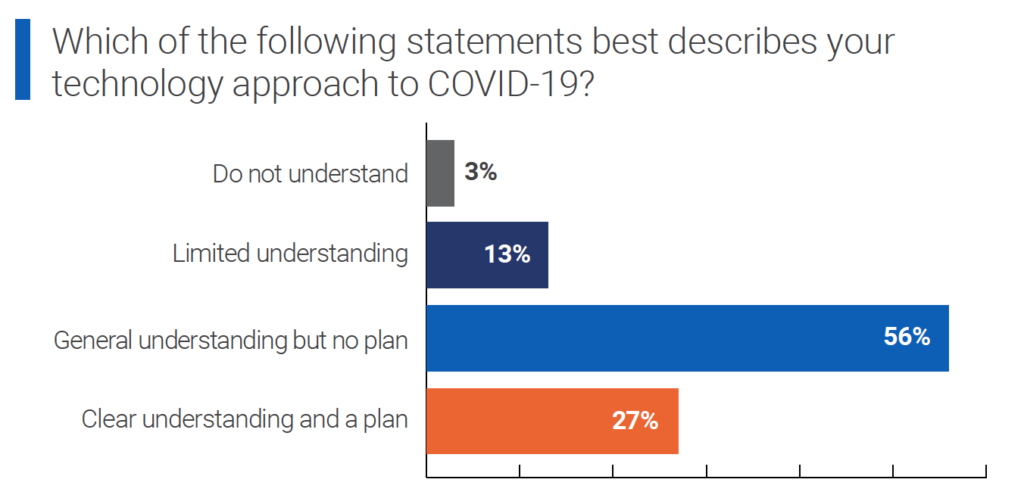

At the same time, many providers aren’t certain what the future will bring, with 56% of all respondents indicating that they have a general understanding of technology use with regard to Covid-19, but without a concrete plan for the future.

In just six short months, the Covid-19 pandemic has turned senior living operations on their head. For many providers, the period has been a “baptism by fire” in using technology, according to Majd Alwan, senior vice president of technology and business strategy and executive director of the LeadingAge Center for Aging Services Technologies (CAST).

For example, many senior living providers are now seeing the value of having robust internet access, which is a “must-have” in any successful tech strategy.

“A lot of the providers that were skeptical about the value of internet connectivity now see why it needs to be available,” Alwan told Senior Housing News.

And it’s not only a must-have for providers. In the age of Covid-19, family members are placing much more value on connectivity in senior living communities, according to Laurie Orlov, a tech industry veteran who is the founder of Aging in Place Technology Watch.

“Families will demand it,” Orlov told SHN. “The need to have technology access in senior living has jumped up a level, and it will stay there.”

Telehealth use rises

Perhaps the biggest way that senior living providers have embraced technology in the last six months is through the use of telehealth. Changes in federal policy and certain allowances or flexibilities from regulators have made it easier to implement and pay for telehealth in the Covid-19 era, and providers have taken advantage of that.

Among the recent survey’s respondents, 68% said their company implemented telehealth since the beginning of the Covid-19 crisis. The main benefit of using telehealth during a pandemic is fairly straightforward: these systems give senior living residents a way to access medical care without leaving the communities where they live.

From his vantage point as an industry-watcher, Alwan said he’s seen significant interest among providers in implementing telehealth, ranging from biometric remote patient monitoring to virtual visits between residents and their physicians.

Among the top reasons why senior living providers have implemented telehealth in their communities, 54% reported convenience, while 49% said greater reimbursement and 28% said cost savings, according to the SHN/Philips survey.

As those answers reflect, recent trends in reimbursement have helped add fuel to the telehealth trend. In April, the Centers for Medicare & Medicaid Services (CMS) implemented new flexibilities regarding telehealth reimbursement, no matter where the patient is located. CMS also increased the number of telehealth services that could be reimbursed by Medicare, including ER visits, nursing facility visits, discharges and therapy services. The agency also created new flexibility to conduct telehealth visits on common video apps such as FaceTime or Skype.

Payers have noted the uptick in usage, according to Andy McMahon, vice president of health and human services policy at UnitedHealthcare Community & State. UnitedHealthcare has seen telehealth “skyrocketing,” with a 20-fold increase in usage among its long-term care population earlier this year before leveling off.

“From where we sit, there’s an enormous opportunity, if we can deploy a remote care management system in a much broader way, that we could dramatically expand the access and reach that we have for our members,” McMahon said on a panel discussion at the recent 2020 Collaborative Care HIT Summit.

Spending trends

The Covid-19 pandemic is driving up expenses across the senior living industry, and technology budgets are no exception.

In the first half of 2020, 17% of respondents reported increasing technology spending by 50% or more, 36% said they increased technology spending by 25% to 50%, and 30% said they increased technology spending by less than 25%. Just 14% reported no change in technology spending in the first half of 2020, while 3% said they actually spent less in that time.

Senior living providers plan to spend even more money on technology in 2021, with 14% planning to increase tech spending by 50% or more, 40% planning to increase tech spending by 25% to 50%, and 33% planning to increase tech spending by 25% or less. Only 12% of respondents plan no change to their tech spending in 2021, while a meager 1% plan to decrease it.

Elevated technology spending is likely to be the state of play for the foreseeable future as the pandemic continues. But, providers will likely be able to amortize large investments over a period of years, or find other ways to make do, Orlov said.

“They’re not going to have a choice,” Orlov said. “And if it causes a problem with their profits for a period of time, so be it, they’ll adjust.”

What providers plan to spend that money on varies, however. According to the SHN/Philips survey, 45% of respondents said they plan to increase their investments in virtual activities and engagement for residents this year and next, while 35% said they planned to invest more in virtual tours during that time and 33% named telehealth and remote resident monitoring.

Other top areas for investments in 2020 and 2021 included resident safety or emergency call systems, infection control, sales and marketing and staffing management.

Some hurdles remain

While it’s clear senior living providers are spending more on technology during the pandemic than in the past, there are still some hurdles to implementing tech. Chief among them: Wi-Fi and building infrastructure, with 34% citing the former, and 30% citing the latter as hindering their ability to implement technology to mitigate the pandemic.

But as Orlov has indicated, families will now more heavily weigh the ability to access technology when choosing a senior living community for their loved ones.

“If you go into a community… and there’s no Wi-Fi in the room, people will not put up with that,” Orlov said. “They may never have asked about it before, but the tour is going to have to include it.”

Dated buildings with older copper wiring are also likely exacerbating the problem. And providers would do well to invest in their infrastructure in the same way they might invest in their high-end amenities, as therein lies a “golden opportunity” to prepare for future technological needs and strategies, according to Alwan.

“Generally speaking in the aging services sector, we invest in refurbishing apartment buildings and campuses with manicured landscaping, with fountains, marble entrances, fancy chandeliers,” Alwan said. “But when it comes to investing in the proper technology infrastructure, we somehow choke on that.”

Whether the senior living industry is truly ready for the next health crisis after Covid-19 largely depends on the characteristics of that crisis. But among the survey’s respondents, there was a sense of optimism, as 28% said they felt fully prepared for the next health crisis and 47% felt mostly prepared.

Alwan agrees with that sentiment — but with a warning that providers should not get complacent about the future.

“Preparedness and technology are both ever-changing,” he said. “And it’s a journey, it’s not a destination.”

Companies featured in this article:

Aging in Place Technology Watch, LeadingAge Center for Aging Services Technologies