Publicly traded senior housing owners and operators begin reporting their Q1 2020 earnings next week, but these financial results will be essentially irrelevant due to Covid-19. Analysts, investors and senior living professionals hope that the earnings reports and comments from executive teams will provide a clearer sense of Covid-19’s effects on the industry and what the next phase of the pandemic will bring.

The U.S. Covid-19 outbreak began in mid-March, at the tail end of the first quarter. From a financial reporting standpoint, the timing was “somewhat convenient,” SMBC Nikko Securities America Analyst Richard Anderson told Senior Housing News.

“You don’t really have this strange partial impact type of scenario — the first quarter will be largely unaffected,” he said.

So, rather than focusing on the Q1 results, investors are “hungry” for real-time metrics and on-the ground information, Green Street Analyst Lukas Hartwich told SHN. April rent collection is one topic of particular interest, as deferrals are widely expected to occur due to the coronavirus crisis.

But while real-time information is valuable, the market may be looking quite a bit beyond the present moment. That’s because even current April numbers “may not tell the story,” Capital One Analyst Daniel Bernstein told SHN. While some metro areas and states were hit hard in April, Covid-19 is peaking at different times in different places.

“Some parts of portfolios are going to be impacted more into May,” he said. “In fact, what we’ve been saying is May results might be worse than April.”

So, expect analysts to press REIT and operator executives on their longer-term strategies and outlooks. Bernstein, for example, is interested in hearing about expectations and plans for when states will begin re-opening for business, and what preparations are underway in case Covid-19 spikes again the fall.

He and other analysts also want to know what operators are doing to control rising expenses.

“We just don’t know how the operators are performing — we only know a couple that are publicly traded,” BMO Capital Markets Analyst John Kim observed. “So, we [want] to get the information from the REITs how they’re managing expenses, what they’re doing to possibly think outside the box.”

And, while acknowledging that Covid-19 demands intensive day-to-day management, the potential that the coronavirus situation could stretch for a year or more until an effective vaccine is developed means that longer-term planning is important.

“I [want] what the road map is, as much as they can give it, in the next 12 to 18 months,” Kim said.

Rent relief in focus

Several REITs have issued periodic updates over the last several weeks, reporting on metrics such as occupancy, Covid-19 infection rates, and increased expenses being incurred by operators. These updates have provided helpful information, analysts agreed. In terms of what additional information they are seeking, several said they want to know about rent collection and rent relief for triple-net lease portfolios.

The health care sector overall experienced a “modest decline” in April rent collection compared to other types of REITs, according to a NAREIT survey. While health care REITs as a whole collected 86% of typical rents, senior housing and skilled nursing payments appeared to be “relatively stable.”

However, some operators — including Welltower (NYSE: WELL) tenant Chelsea Senior Living — have reported that they need rent relief, given that their expenses have spiked while their revenue is being squeezed by a slowdown in move-ins.

One of the “Big 3” health care REITs, Chicago-based Ventas (NYSE: VTR), already has introduced a rent deferral program. Ventas tenants had an option to defer 25% of April rent until Oct. 1, 2020 or the receipt of government assistance. The REIT expected April deferrals to total $3 million to $9 million.

Other REITs likely will be more “surgical” in their approach to rent relief, Anderson believes, but will provide assistance to operators when needed.

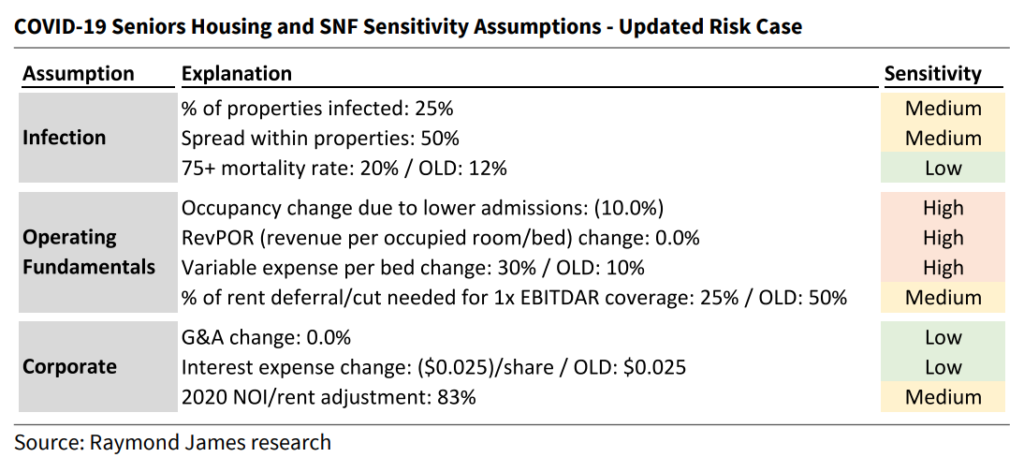

Looking at REITs’ senior housing and skilled nursing portfolios, Raymond James Analyst Jonathan Hughes ran a sensitivity analysis based on several assumptions. He is anticipating that 2020 rent deferrals or cuts will need to be about 25% to achieve 1x EBITDAR coverage. A few weeks ago, he was assuming a 50% rent deferral or cut would be needed, but he revised that number down mainly due to financial support that skilled nursing providers have received from the government, he told SHN.

Several analysts, including Anderson, pointed out that rent coverage for some triple-net portfolios was thin prior to Covid-19. This puts additional pressure on REITs to be proactive now.

“We have been critics of the REITs for, in years previous, being a bit too aggressive with escalators and allowing rent coverage to trickle down in some cases to parity if not lower, and that’s before CapEx,” Anderson said. “So, it’s time to address that in this situation.”

Going into Covid-19, some REITs already were beginning to rethink their triple-net structures. For example, Murfreesboro, Tennessee-based National Health Investors (NYSE: NHI) began reducing escalators and tying them to the consumer price index. Covid-19 could further accelerate these adaptations, in Anderson’s view.

“I think there will be some thought given [to these issues] and perhaps … will bring some perspective to the industry that maybe got lost over the past five or 10 years,” he said.

Hartwich also flagged that rent coverage was thin prior to Covid-19 — and in keeping with the theme that analysts are seeking long-term visibility, he is hoping for some insight into how investors should be thinking about rent relief over the next several years.

Specifically, he’s seeking clarity on rent deferrals versus abatements, and whether REITs will accelerate their timeframe for addressing triple-net leases where rent coverage was below market even before Covid-19 struck.

Despite the risks of rent deferrals or cuts and the need to rethink escalators, triple-net leases are still seen as a fundamentally safe structure, given how they insulate REITs from the fluctuations of operating NOI. Analysts generally agreed that Covid-19 will not dramatically alter REITs’ or investors’ take on the merits of triple-net versus RIDEA.

There has been a shift in recent years toward RIDEA. REITs such as Welltower and Ventas with more exposure to RIDEA will experience more immediate pain due to Covid-19 but will enjoy more upside when a recovery occurs, Bernstein noted. Anderson struck a similar note in terms of RIDEA versus leases.

“It’s six of one and half-a-dozen of another,” he said.

2020 forecasts

Covid-19 caused several publicly traded senior housing companies to pull their 2020 guidance, and analysts and investors have been doing their best to project how the year might play out based on available information. They are hoping to refine their predictions based on what they learn in the upcoming earnings.

One major challenge is that Covid-19 has been a rapidly evolving crisis, with the federal government and states responding in different ways. So, predictions about how senior living will fare have encompassed a range of possible scenarios. For instance, BMO’s Kim has suggested that occupancy could decline by 50% in a worst-case scenario, although he believes a much more modest 14% decline over the next four quarters is more likely.

Hughes is anticipating a 10% drop in occupancy for 2020 across senior housing and skilled nursing, due to lower admissions.

Numbers such as these are based on the latest REIT updates, such as one from Welltower that reported a decline from 85.4% to 84.2% in its senior housing operating portfolio between March 27 and April 10.

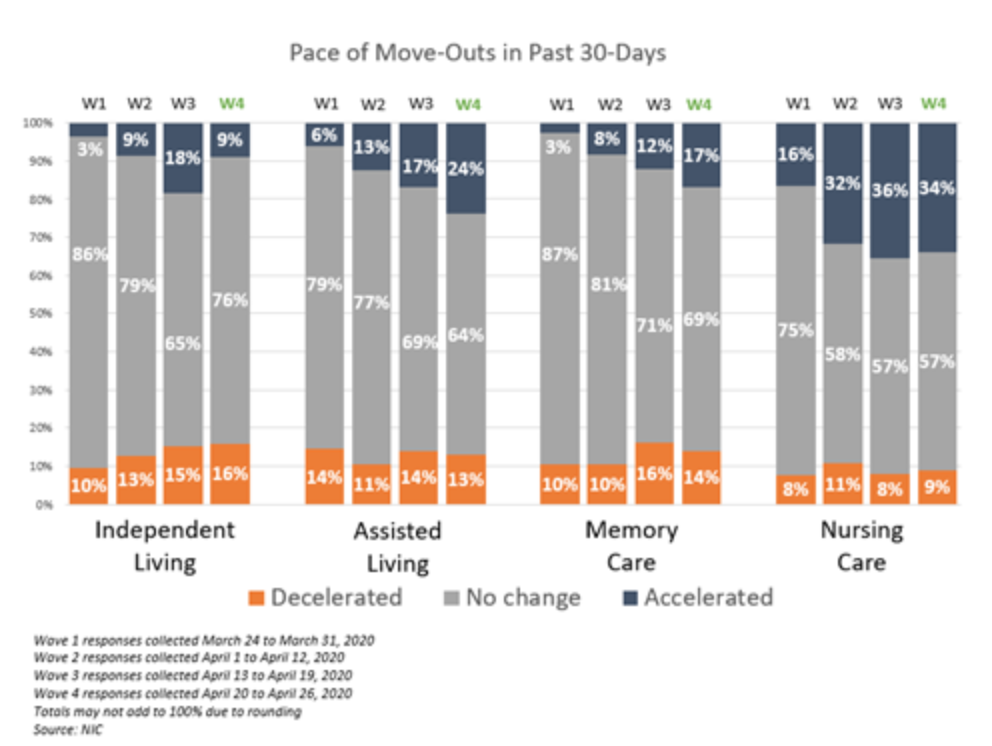

The National Investment Center for Seniors Housing & Care (NIC) is another data source. NIC has been surveying senior housing providers on a weekly basis and released its latest survey results on Thursday.

Executives with 94 senior housing and skilled nursing companies nationwide responded to the survey, which found that 81% of assisted living organizations have seen occupancy decline over the last 30 days.

Notably, the pace of move-outs has also accelerated in assisted living. For the week of April 20-26, 24% of assisted living providers reported accelerated move-outs, which was up from 17% the week prior.

This could be ominous news, given that providers and REITs alike have said that move-outs have not spiked during Covid-19. However, the percentages still “represent the relative minority” of respondents, NIC Senior Principal Lana Peck noted to SHN.

In its next weekly survey, NIC is collecting more information to ascertain why move-outs accelerated, she said.

There are various reasons for the overall occupancy dips in senior living, with most respondents to the NIC survey citing a slowdown in lead conversions and sales, followed by an organization-imposed ban, and then resident or family member concerns.

These issues will not be resolved quickly or easily, as Covid-19 demands that communities severely curtail tours and move-ins. However, new admissions are still occurring, and especially as more testing becomes available and states relax stay-at-home orders, senior living providers could conceivably begin to rebuild occupancy.

“The monthly incremental vacancy rate could be in the range of 100 to 200 basis points per month, and exactly how operators are combating that will be the story in the second quarter and going forward,” Anderson said.

But even if census can rebound, rental rate growth could remain stagnant or even dip into negative territory. Capitol One’s Bernstein believes that if occupancy falls into the 80% range, “it’s hard to believe” that rate growth will stay positive — which it did even in the midst of the last financial crisis.

Hughes is more optimistic on rates. Rent increases are unlikely, but he thinks that providers will make strenuous efforts to avoid discounting. For example, executives with Brentwood, Tennessee-based Brookdale Senior Living (NYSE: BKD) — the nation’s largest provider — earlier this year said they were not going to give away rate as they did the previous two years.

“The discounting was beginning to taper off in front of this, and I think they’re providing a very valuable service to their residents, and most families will agree,” he said.

Expenses are another story, though — here, the picture has become worse than Hughes anticipated at the start of the Covid-19 crisis.

Irvine, California-based Healthpeak (NYSE: PEAK) reported that operators’ labor expenses could increase by 5% to 15% during the pandemic, while spending on personal protective equipment (PPE) could increase by 2x to 5x. The industry as a whole could be facing a $57 billion hit due to Covid-19, according to a third-party analysis shared by industry groups Argentum and the American Seniors Housing Association (ASHA).

Hughes is now assuming an annual 30% increase in variable expense per bed, up from 10% in an earlier projection.

Some smaller senior living providers have been able to secure funds through the federal Payroll Protection Program (PPP), and the analysts are interested in learning more about the financial support that operators are receiving. But, it’s almost certain that with expenses on the rise and occupancy falling, net operating income (NOI) and operating margins will take a hit.

Hughes, for example, is expecting that for REITs’ senior housing and skilled nursing portfolios, 2020 NOI/rent could be down in the range of 17% to 46%, depending on the particular factors at play for each company. And Bernstein is mulling the possibility that senior housing will be a lower margin business going forward if some of the new expenses related to PPE or increased building costs stick.

“Is this industry now a 25% margin industry versus, say, 30%?” he said. “That makes a big difference in how you perceive risk, and a big difference in how you perceive value, what you might pay for assets — conceptually, lower margins equal higher cap rates.”

The margin situation could become more obvious going into 2021 or 2022, he thinks.

The good news is that there is no debt or credit crisis as there was in the Great Recession, BMO’s Kim noted. REITs have taken steps to shore up liquidity. But, if operators require more financial support than investors are currently pricing in, or if there are operator bankruptcies, that could send senior housing stocks crashing again, as they did at the outset of the coronavirus crisis.

Barring any unforeseen disclosures, however, Kim and other analysts believe that the earnings season will not send shockwaves through the investment community.

“Knee-jerk” sell-offs could occur, as not all investors have been paying close attention to the REITs’ periodic updates, Anderson noted. But he thinks the earnings season will not lead to any “sustained” change of sentiment on the sector.

Possible ‘super-cycle’

Looking further out than 2020 may seem impossible, or at least foolhardy, given all the unknowns at the present moment. But senior housing investors have had their eyes on the long-term for years, awaiting the arrival of the vast baby boomer generation.

Covid-19 does not fundamentally alter the longer-term case for senior living, several analysts emphasized.

“I’m optimistic about the business longer term, no question about it,” Anderson said.

Bernstein is also bullish, as he foresees a potential “super-cycle” for senior living that could begin in late 2021 or 2022.

“Despite all the turmoil and uncertainty of the next six to 12 months, I actually feel better about the longer-term upside and supply-demand dynamics over the next five years than I did eight weeks ago,” he said.

Prior to Covid-19 upending the industry, oversupply was one of the most significant near-term challenges facing senior living. Now, construction almost certainly will slow and could drop even lower than it did in the Great Recession, Bernstein believes.

In particular, he’s looking at supply-demand dynamics through the lens of trailing 12-month construction starts to existing supply, as a ratio against forward demographic growth of the 80-plus population. At the bottom of the Great Recession, the lowest that ratio got was 1.3. Assuming a 1% fall off in new starts today, and given the demographic growth of older adults through 2024, the ratio goes to around 0.5.

In addition, although not all the effects of acuity creep have been positive for the industry, even independent living is a more needs-based product that it was 10 or 15 years ago, he observed. This could dampen a feared dropoff in move-ins due to older adults becoming wary of infection risks related to communal living.

However, even active adult settings — as long as they have some sort of health care component, such as through a partnership with a managed care plan — could have great appeal for older adults post-Covid, Bernstein and Hughes said.

But demographics alone aren’t enough to fuel demand. Senior living owners and operators must also rise the challenge posed by the coronavirus. Keeping this fact in focus may be paramount amid all the information, conjectures, hopes and fears that are sure to surface during this earnings season.

“I think for the most part, the industry is going to come out of this looking like they took corrective action,” Bernstein said. “There is that opportunity to be able to say, we protected mom and dad better than they could have been in your house … to me, that’s a good selling point.”

Companies featured in this article:

BMO Harris, Brookdale Senior Living, Capital One, Chelsea Senior Living, Green Street Advisors, Healthpeak Properties, NHI, Nikko Securities America, Raymond James, Ventas, Welltower