The Covid-19 pandemic is expected to cut into senior housing operators’ bottom lines and lead to near-term cap rate expansions — but the industry’s long-term prospects are still likely sound, according to a new report from commercial real estate services firm Jones Lang LaSalle (NYSE: JLL).

It’s no secret the pandemic has made it harder for senior housing operators to maintain census. In fact, 68% of independent living providers, 81% of assisted living providers, 68% of memory care providers, and 82% nursing care providers reported a decline in occupancy compared to the prior month, according to an April 26 NIC survey of 146 senior housing and skilled nursing operators.

At the same time, providers are spending sizable amounts of money trying to procure personal protective equipment (PPE), with a forecasted spend of $500 to $700 per unit on PPE alone, according to NIC.

While those challenges are expected to leave with the pandemic, they are having an impact on net operating income (NOI) now. JLL expects negative NOI growth through the remainder of 2020, with an average NOI growth of about 3% in 2021 and 2022. Operators may see reabsorption of four to five residents per month due to a higher-acuity population and a more strict regulatory environment, with more need-driven senior housing properties expected to lead the way to recovery. Still, the industry’s long-term fundamentals remain strong, according to Zach Bowyer, a managing director at JLL who authored the report.

“This is far different from 2008, where capital dried up and liquidity disappeared due to poor lending practices,” Bowyer told Senior Housing News. “I think once we get through this, the data will show that seniors living in seniors housing communities were better off from a safety and care perspective than those living alone.”

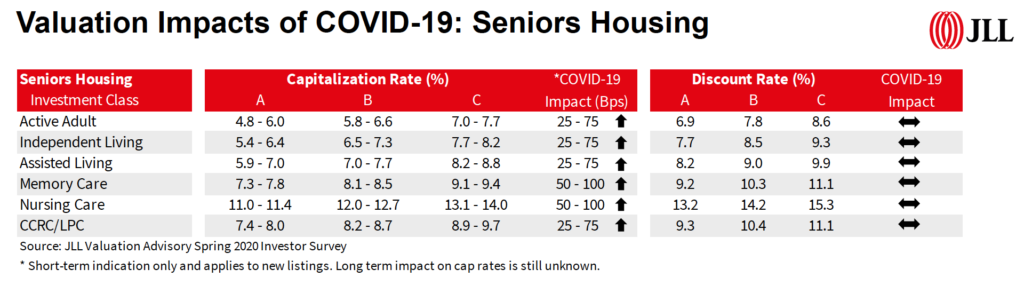

In the short-term, the pandemic is expected to drive up capitalization rates, according to JLL. For life plan communities and active adult, independent living and assisted living properties, cap rates could expand by 25 to 75 basis points. For memory care and skilled nursing properties, cap rates could grow by 50 to 100 basis points. But cap rates are expected to normalize once the pandemic ends, Bowyer added.

Meanwhile, the rate of new senior housing deals has slowed down, and lenders are now asking for a requirement of 12 to 18 months of debt service reserve to help underwrite the new and increased risk. In the short-term, valuations are being reported at a 5% discount to pre-Covid prices. And the number of rent deferrals or loan forgiveness requests is increasing, according to JLL.

And, despite the increased risk of Covid-19, long-term demand is expected to remain strong, as favorable demographic shifts and government support in the form of the $2 trillion CARES Act remain in play, the report noted.

JLL is not alone in its assessment that cap rates are likely to rise in the near-term. Like JLL, others believe that, while Covid-19 is making senior housing a riskier short-term play, demographic shifts will make the property type a safer bet in the long-term.

“I anticipate that there will be an expansion of cap rates in this sector on a relative basis in the near-term,” Heitman Senior Managing Director Mary Ludgin said during a recent National Investment Center for Seniors Housing & Care (NIC) webinar. “Long-term … the demand is strong, and this pandemic is not going to change that meaningfully.”