Continuing care retirement communities (CCRCs) around the country are facing a potential Medicaid policy change that could result in new tax bills running to six or seven figures — and their residents are speaking out.

The potential change stems from a proposed rule issued in Nov. 2019 by the Centers for Medicare & Medicaid Services (CMS). The Medicaid Fiscal Accountability Regulation (MFAR) proposal contains several provisions that have drawn fierce pushback from skilled nursing facility providers, which draw a majority of their revenue from Medicaid. These operators fear that MFAR will eliminate certain supplemental payments, which they say would result in devastating financial consequences and a rash of SNF closures.

CCRCs, also known as life plan communities, often include a skilled nursing component, and they too could suffer from the supplemental payment changes. However, the more widespread and pressing issue for CCRCs relates to provider taxes.

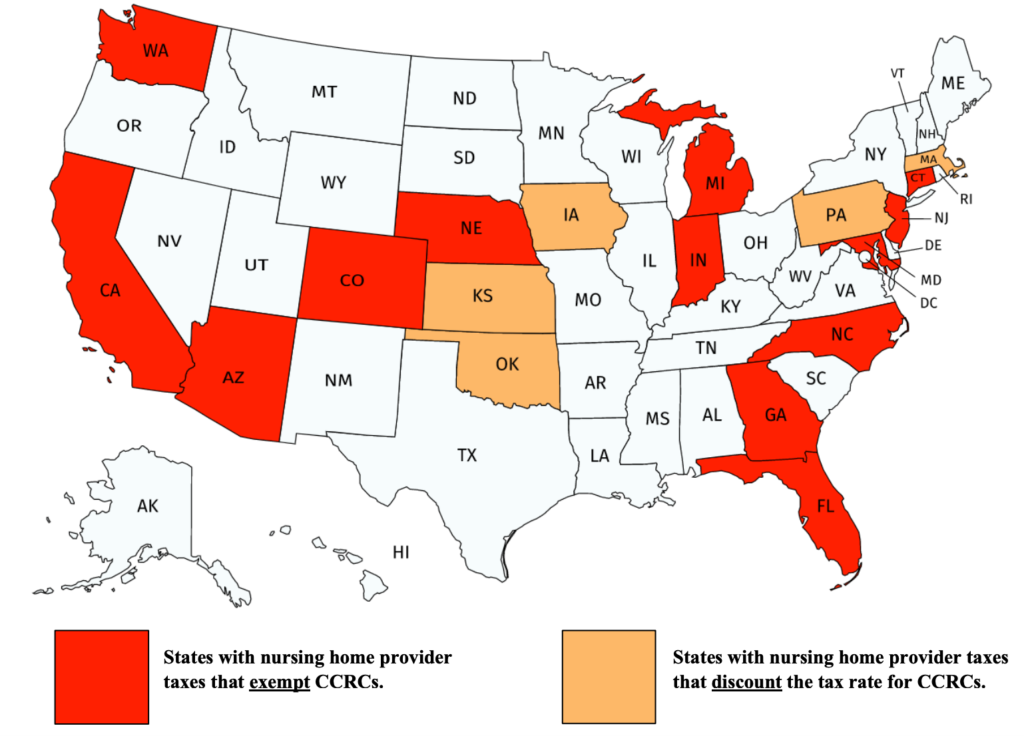

States often levy a tax on skilled nursing facilities, sometimes known as a provider assessment or bed tax, and these tax payments in turn generate federal matching funds to help support the state’s Medicaid program. Given that the majority of CCRC revenue stems from private-pay residents, many states exempt CCRCs from these taxes, or tax them at a lower rate. Under MFAR, states may no longer have the latitude to extend these tax breaks.

The public comment period for the proposed rule is scheduled to end on Feb. 1. As of Jan. 31, CMS had received more than 2,300 comments — many of them warning of the threat to CCRCs and their residents.

“Most CCRCs would not be able to absorb new taxes without cutting services, passing the new costs along to their residents or closing their nursing homes entirely,” industry association LeadingAge wrote in its comment. “In other words, older adults in CCRCs would likely bear the brunt of the proposed MFAR if finalized.”

Previously, LeadingAge and the National Continuing Care Residents Association sent a joint letter to legislators pressing their case against MFAR. That letter estimated the potential tax burden on CCRCs to range between six and seven figures, depending on state-specific variables. The letter also identified 13 states that currently exempt CCRCs from SNF provider taxes and five states that discount the tax rate.

Many CCRC residents have been briefed on the situation and also submitted comments pushing back against MFAR.

Susan Dietrich, a resident of Vi at Bentley Village in Naples, Florida, noted in her comment that she carefully planned for her retirement, including by purchasing her continuing life contract with Vi in 2018. Should MFAR be finalized as written, Florida CCRCs would collectively face $25 million a year in new taxes, she wrote.

“Because owners would pass on the costs of these new taxes, each resident would face at least $1,000 in additional costs per year,” she wrote.

LeadingAge is pushing for CMS to withdraw MFAR and take a “consensus, data-driven approach” to Medicaid payment changes. Other groups, including the American Health Care Association (AHCA), have also rallied against MFAR.

For its part, CMS stated in rolling out MFAR that “shady” schemes are driving up the federal government’s Medicaid payments to states, and therefore reform is needed.