Senior housing properties that are majority independent living were offering initial discounts equivalent to 1.1 months of rent on an annualized basis as of September 2019, on average.

This is the highest average discount on initial rates for independent living since April 2015, when the National Investment Center for Seniors Housing & Care (NIC) first began reporting this data.

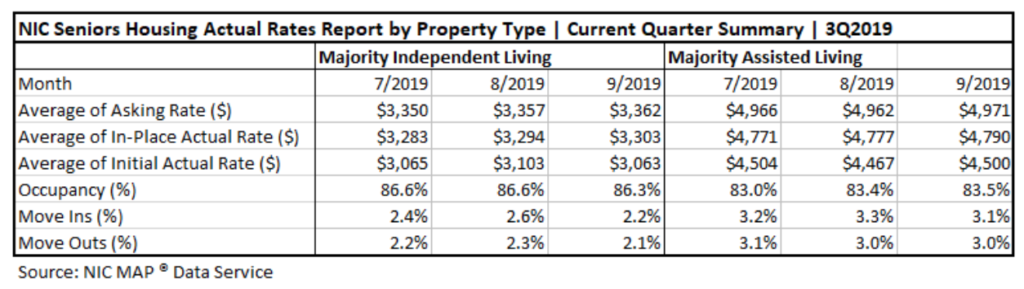

Independent living properties have also lost pricing power on a year-over-year basis, according to the data that was shared in a recent blog post by NIC Chief Economist Beth Mace. In September 2019, the average asking rate for IL properties was 1.1% higher than the year prior, and this represents the smallest annual increase since February 2018.

Historically, the gap between asking rates and actual initial rates has been larger for assisted living than independent living. That changed in January 2019 and lasted for several months, before shifting back to being larger for assisted living, Mace wrote. As of September, the average discount for both settings was about the same.

For both majority IL and AL properties, the rate of move-ins continued to outpace move-outs in September, although the spread narrowed compared with the summer months of July and August.

The actual rates report from NIC aggregated data from about 300,000 units across more than 2,500 U.S. properties operated by 25 to 30 providers.

Average occupancy remained higher in September for majority IL (86.3%) than majority AL (83.5%) — a trend that has been consistent over the last several years as oversupply hit the assisted living segment harder. However, the independent living market is facing some potential headwinds.

There are signs that the residential real estate market could be cooling, and this could make it more difficult for older adults to finance their moves to senior housing, Fitch Ratings cautioned in its recently released outlook on non-profit life plan communities. Over the course of 2019, the active adult space has also has heated up considerably, raising questions about whether these communities are an alternative to traditional IL. Some large active adults players contest this notion, however, saying that their resident profile is distinct from independent living.