There are signs Brookdale Senior Living’s (NYSE: BKD) improvement efforts are producing results, as the company reported improved employee retention and move-in growth in the second quarter of 2019. But, there’s more to do as the company’s ongoing turnaround approaches the halfway mark.

If Brentwood, Tennessee-based Brookdale entered the first inning of its turnaround last year, it’s now in the fifth inning, CEO Cindy Baier told Senior Housing News.

“We’ve set the foundation of our strategy, we’ve demonstrated progress on our execution, we’ve built real, positive momentum, and we’re optimistic about future prospects,” Baier told SHN. “We can also see the benefit of the change that’s happening in the competitive environment, where supply and demand are soon approaching equilibrium.”

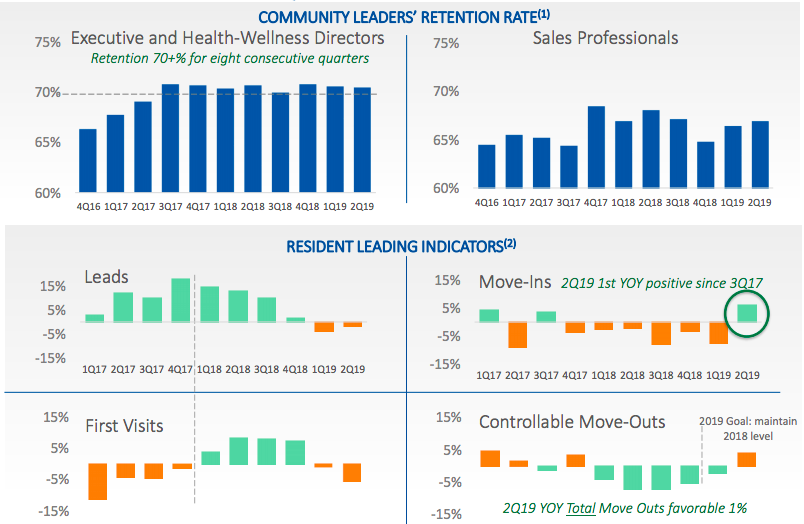

The senior living owner and operator reported a 6% year-over-year improvement in move-ins in the second quarter, in an earnings call with investors and analysts Tuesday. That’s the first time move-ins grew on an annual basis since the third quarter of 2017.

Brookdale’s retention rates for executive directors and health and wellness directors remained around 70% for the past eight consecutive quarters. The company also welcomed 2,100 former associates back into the fold this year.

Brookdale logged an independent living occupancy rate of 89.1% in the second quarter of 2019, representing year-over-year growth of 100 basis points, according to an Aug. 5 SEC filing. Assisted living and memory care occupancy declined 80 basis points year-over-year to land at 83.5%.

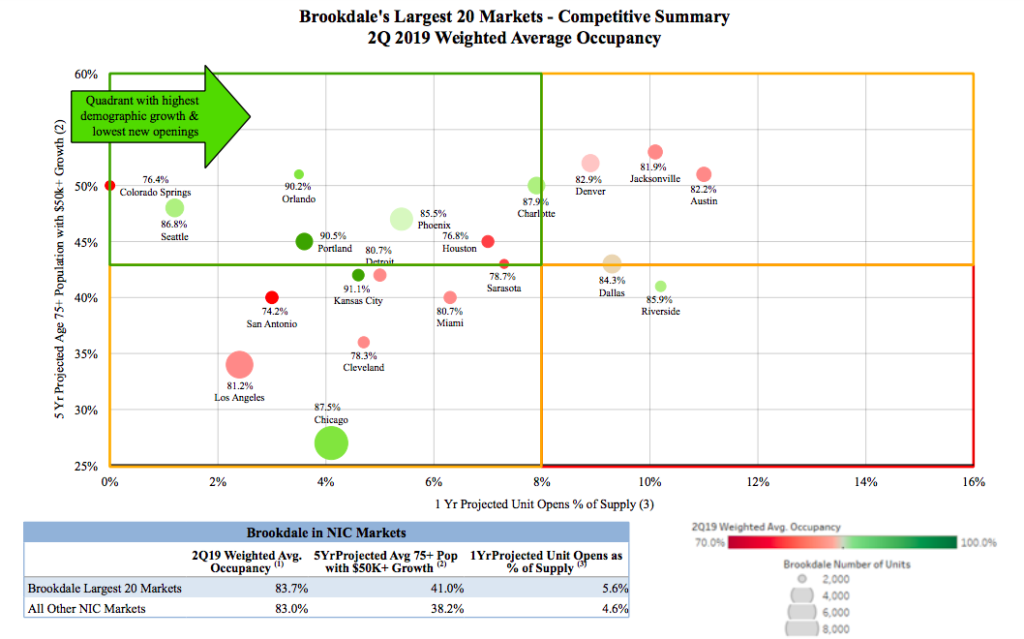

On a same-store basis, Brookdale’s weighted average senior housing occupancy for the quarter was 83.7%, a decline of 110 basis points from the 84.8% it reported this time last year. That compares to overall senior housing occupancy of 87.8% in Q2, as measured by the National Investment Center for Seniors Housing & Care (NIC).

Brookdale was pushing rates in the quarter to drive financial performance. Same-store revenue per available room (RevPAR) increased 3.3% on a year-over-year basis, and the company saw Q2 resident and management fee revenues of $817.3 million.

Brookdale is the largest senior living operator in the U.S., with 809 Communities spread across 45 states. After acquiring rival Emeritus Corp. in 2014, Brookdale went through a rocky integration process and then faced other challenges, including a substantial influx of new senior living supply. Baier has been leading an operational turnaround since becoming CEO at the beginning of 2018.

‘Competitive headwinds are lessening’

As Baier noted, the national slowdown in senior housing construction starts has been a boon for Brookdale, not to mention the entire industry. New construction within 20 minutes of a Brookdale community is down 51% compared to the same time last year.

“There’s no question that oversupply has been a very real issue in our industry, and it has affected Brookdale more than others, historically, because we have such a large concentration in assisted living … as well as memory care,” Baier told SHN. “We’re seeing supply and demand improving and we’re definitely well-positioned, as aging baby boomers will be considering senior living in the not-too-distant future.”

Between Jan. 1 and June 30 of this year, Brookdale built occupancy faster than any point in the past three years, Baier said.

“We feel like we’re making great progress, and there’s a lot to look forward to in the second half of 2019 and beyond,” Baier said. “[That’s] largely attributable to the success of our operational turnaround strategy, but also because the competitive headwinds are lessening.”

Brookdale has also worked to optimize its sales and marketing processes, including by initiating several pilots to accelerate improvements in its sales cycle in the second quarter of this year.

In one of those pilots, the company tasked an executive team with aiding 30 communities that showed promise for improvement. That effort helped grow occupancy at those communities, and Brookdale plans to add another 20 communities to the pilot soon. In another pilot that bore fruit, Brookdale used data analytics to target digital marketing investments in select cities where it operates.

“Based on the positive uptake and move-ins we will extend this success by continuing our digital marketing investments in the third quarter,” said Steve Swain, Brookdale CFO, on Tuesday’s call.

The company also earlier this year hired Rick Wigginton, a former senior vice president of sales and marketing with Holiday Retirement. Wigginton now serves as Brookdale’s head of sales and is “off to a great start,” Baier said.

In addition to the sales and marketing efforts, Brookdale communities are getting upgrades thanks to a $250 million capital expenditure spending package spread across 500 projects this year.

Brookdale also opened two new senior housing projects in the second quarter: a newly constructed assisted living and memory care building at a Brookdale community in Williamsburg, Virginia, and a new memory care wing at Brookdale Skyline in Colorado.

The company touted a recent 20% gain in its net promoter score (NPS) as proof that its approach was making a meaningful impact among its residents.

Despite Brookdale’s solid progress this quarter, the company has more ground to make up, with its occupancy being a crucial long-term bellwether, according to Stifel analyst Chad Vanacore.

“[Brookdale’s] 2Q19 results were solid,” Vanacore wrote in a note to investors. “We expect 2019 to remain challenged with occupancy and expense pressures as the industry wrestles with oversupply and labor expense inflation.”

Brookdale’s second-quarter results show reflect incremental improvement in the company’s ongoing turnaround strategy, according to RBC Capital Markets analyst Frank Morgan.

“Progress with turnaround initiatives continues with early occupancy pickup, move-in growth, and improved retention,” Morgan wrote in a note to investors.

Brookdale’s share price gained 6.13% to rest at $7.79 by the time the markets closed Tuesday.

Land & Buildings rebuttal

Baier also took a moment Tuesday to push back against activist shareholder Land & Buildings’ proposal to split Brookdale into an operating company and a real estate ownership company, an arrangement otherwise known as an “OpCo/PropCo.”

Land & Buildings this year tapped the advisory and consulting arm of Green Street Advisors to value Brookdale and its real estate as well as comment on the feasibility of undertaking a PropCo/OpCo split. In its preliminary analysis, the advisory said that the REIT’s net asset value is above its current share price, and that there may be viable OpCo/PropCo structures that could boost share values up to double what they are now.

But Baier took issue with the group’s analysis, citing previous consultations with independent financial advisory firms BoA Merrill Lynch and Morgan Stanley that found such an OpCo/PropCo arrangement would be “imprudent.”

“There were fundamental flaws in [the Green Street advisory group’s] theoretical assessment of a PropCo/OpCo structure,” she said during Tuesday’s earnings call. “Those flaws include disregard of numerous critical, practical and market considerations and execution risk and the use of unrealistic assumptions.”

Green Street’s advisory group declined to comment on Baier’s remarks, while Land & Buildings reiterated the points it made in its latest open letter to shareholders when reached by Senior Housing News.