After reversing a downward trend in the first quarter of 2019, the occupancy rate for U.S. senior housing communities declined slightly in the second quarter, according to new data from the National Investment Center for Seniors Housing & Care (NIC).

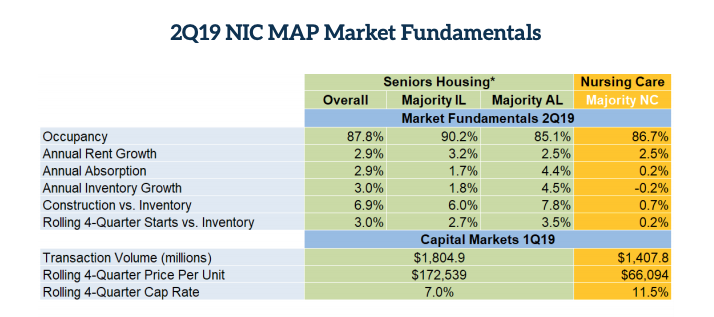

The overall occupancy rate dropped 0.3 percentage points to 87.8% in Q2, marking the lowest level since the second quarter of 2011. Occupancy in independent living communities fell to 90.2% in the second quarter, while the rate of occupancy in assisted living communities reached an all-time low of 85.1%. The most recent high occupancy rate of 90.2% was set in the fourth quarter of 2014.

Courtesy of National Investment Center for Seniors Housing & Care (NIC)

Courtesy of National Investment Center for Seniors Housing & Care (NIC)As in previous quarters, occupancy varied widely among the 31 major markets which NIC tracks. In fact, there was a 17 percentage point spread in occupancy across those markets, with San Jose, California, at the high end (95.7%) and Houston at the low end (81.1%). Houston’s occupancy, however, rose 2.2% sequentially.

San Antonio experienced the largest year-over-year growth in occupancy, from 78.5% to 82.9%, while Los Angeles saw the largest year-over-year decrease, falling from 90.1% to 87.9%.

Local markets can vary due to the local economy, barriers to entry like zoning, land values and regulations or other factors such as changing demographics, according to Beth Burnham Mace, NIC’s chief economist.

“Markets in Texas may be easier to develop senior housing than in California,” Mace told Senior Housing News. “Sometimes the best use for land in California may not be senior housing.”

Despite the occupancy rate declines, however, NIC’s data suggests construction continues to slow, which should bode well for future occupancy. There were 19.113 new construction starts in NIC’s 31 primary markets in the last four quarters, the lowest numbers since 2014. These construction starts amounted to 3% of total existing senior housing inventory, down from 4.3% a year ago. The dropoff was most acute in assisted living, where construction accounted for 3.5% of overall inventory in the second quarter. That is the lowest number since late 2015, when construction as a part of inventory reached 6.5%.

“This should translate into slowed inventory growth moving forward. If demand holds, occupancy rates will trend upward,” Mace said.

The Q2 2019 absorption rate was 2.9%, a 0.1 percentage point dropoff from the previous quarter. Inventory growth dropped 0.1 percentage point, to 3%, but assisted living inventory growth decreased to 4.5% over Q1’s 4.9%.

“Industry leaders should keep an eye on this data going forward to make informed decisions on new developments and other potential investments,” Mace said.

Rent growth also dropped sequentially in Q2, to 2.9% versus Q1’s 3%. Mace advised investors to monitor rent growth, as it is being outpaced by wage growth. The Bureau of Labor Statistics reported hourly earnings for assisted living increased 4.6% in the first quarter, year-over-year.

“Operators will continue to be under pressure, as the disparity between wage and rent growth is putting a squeeze on some,” Mace said.