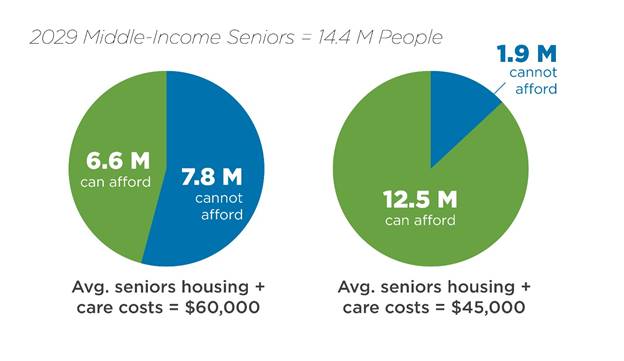

Millions more older Americans could afford private-pay senior living and over the next decade if providers find a way to trim average annual cost for residents by $10,000 to $15,000 per resident.

That’s according to a new analysis of research on the middle-market opportunities and challenges for the senior living industry. The research — conducted by a team from the National Investment Center for Seniors Housing & Care (NIC), NORC at the University of Chicago, Harvard Medical School and the University of Maryland School of Medicine — showed that slightly less than half of all middle-income older adults will be able to afford to move into a senior living community by the year 2029.

“The senior housing industry has been so laser-focused on the very highest income cohort,” Caroline Pearson, lead researcher of the study at NORC at the University of Chicago, told Senior Housing News. “But small reductions in annual cost could bring a lot more people into this market.”

Some possibilities for threading the needle in senior living affordability will be discussed today during an event in New York City.

Should senior housing and care providers find a way to drive down average annual resident rates and out-of-pocket medical expenses by $15,000, an additional 5.9 million older adults — or 12.5 million total — would be able to afford their services. Even a smaller cut to resident rates can go a long way. Trimming annual average rates by $10,000 per year would make senior living affordable for 2.3 million more older Americans.

To help drive the point home, NORC has released an interactive tool to explore the cost alternatives and potential impact on senior living affordability.

The tool can assume a range of annual cost assumptions for seniors from $40,000 at the low end to $75,000 at the high end. Users also have the ability to toggle housing equity on and off and decide whether out-of-pocket medical costs will come in less expensive ($5,000) or more expensive ($10,000).

The latest analysis provides more evidence for senior living investors, owners and operators that, while there is a substantial challenge to reducing costs per resident, there is also a big opportunity in doing so, Pearson said.

Driving down costs

If senior living providers are going to reduce costs to a manageable level for middle-market adults, it’s going to take some innovative solutions. In other words, “it’s a time to throw spaghetti against the wall,” as Beth Burnham Mace, chief economist at the National Investment Center for Seniors Housing & Care (NIC), told Senior Housing News in April.

What those solutions may look like is still hazy, however.

“Some people have thrown out the idea that we should accept lower returns and just take it out of profit,” Pearson explained. “Others have said you could design facilities that are slightly less well-appointed in terms of luxury amenities and potentially have some lower construction costs.”

Other ideas include:

- Leveraging existing and new technology

- Subsidizing less expensive care settings with residents who pay more

- Finding new investment or sources of capital

- Coming up with new uses for existing properties such as shopping malls

- Filling the gap with unpaid or family caregivers

- Developing different real estate financing models.

Still, all of this likely depends on what investors decide is tolerable.

“The big takeaway is, we have ignored the middle market of seniors housing for a very long time, and as the baby boomers age, the size of that population is going to grow dramatically,” Pearson said. “Innovative private-sector solutions in combination with policy solutions is going to be needed to serve the next generation as they get older.”