The occupancy rate for U.S. senior housing communities remained about even in the first quarter of 2019, according to new data from the National Investment Center for Seniors Housing & Care (NIC). And construction starts appear to be slowing, suggesting an ongoing cooldown in new supply.

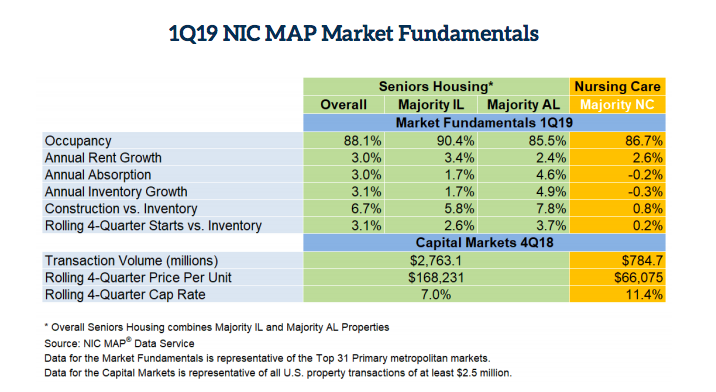

Senior housing occupancy was 88.1% for the first quarter of this year, up 0.1 percentage points from the previous quarter’s total of 88%. Despite the sequential increase, current national occupancy rates are still 0.2 percentage points below what they were during this time last year, and 2.1 percentage points below the most recent high of 90.2% in the fourth quarter of 2014.

As in previous quarters, occupancy varied widely among the 31 major markets which NIC tracks. In fact, there was a 17 percentage point spread in occupancy across those markets, with San Jose, California, at the high end (94.1%) and Houston at the low end (77.1%).

The largest occupancy increase occurred in Las Vegas, where rates went from 86.0% in the first quarter of 2018 to 87.9% during the same period in 2019. The biggest decline occurred in Houston, where occupancy fell from 78.9% in the first quarter of 2018 to 77.1% during the same period of 2019.

Local markets can vary due to the local economy, barriers to entry like zoning and regulations or other factors such as changing demographics, according to Beth Burnham Mace, NIC’s chief economist.

“We have been seeing large differences in occupancy rates for some time among the markets NIC tracks,” Mace told Senior Housing News. “Like all of real estate, the adage of ‘local, local, local’ applies.”

Ongoing erosion in senior living occupancy has been tied to elevated levels of supply in certain markets, with providers citing major challenges posed by new competition as far back as 2016. The tide may be slowly turning, as the latest data from NIC showed construction starts slowing.

Construction starts totaled 4,003 units in the first quarter of 2019, with demand slightly outpacing inventory growth, according to preliminary data analyzed by NIC.

Construction as a share of existing inventory for senior housing, meanwhile, was 6.7% in the first quarter of 2019, a dip of 0.8 percentage points below the recent high of 7.5% in the fourth quarter of 2017.

“I am conservative by nature, so I would prefer to see a few more quarters of data demonstrating this trend,” Mace said. “But I think even with that conservative bend, we can say that starts have passed their peak for this cycle, especially for assisted living, which means that inventory growth is likely to slow in the months ahead.”

A few different factors might be contributing to the construction slowdown.

“I think there have been a lot of prognosticators; practitioners; commentators, including NIC; lenders; operators and investors that have been talking about too much supply in some markets, and as a result, there has been a more cautionary approach to new development which is translating into fewer starts,” Mace said. “There is also a shortage of construction workers and building costs have been rising, which is contributing to cancellations and delays in new construction.”

The absorption rate for the first quarter of 2019 was 3.0%, an increase of 0.3 percentage point from the fourth quarter of 2018, and a gain of 0.7 percentage points when compared with the first quarter of 2018. While the inventory growth rate in the first quarter of 2019 was slightly higher than the absorption rate at 3.1%, it dropped 0.4 percentage points from the fourth quarter of 2018.

Rent growth for the first quarter of this year was 3%, representing no change from the fourth quarter of 2018.

Looking ahead, demand should continue to stay strong as long as the U.S. economy remains relatively robust.

“Keep in mind that demand hit a record high unit level in the fourth quarter for senior housing for the NIC MAP 31 primary markets,” Mace added. “If inventory growth slows and demand remains at the pace recently seen, occupancy rates should begin to edge higher.”