It’s official: after a 13-month search process, Amazon announced today it will split its second headquarters between Long Island City in Queens, New York and Crystal City in Arlington, Virginia. Amazon will invest $5 billion to create 50,000 new jobs between the two cities. Additionally, the e-commerce giant will open a new Operations Center of Excellence for its fulfillment, supply chain and transportation businesses in Nashville, Tennessee. The center is expected to bring 5,000 jobs to Music City.

With that comes the “Amazon effect” on real estate and population trends, which can have a long-term impact on senior housing, National Investment Center for Seniors Housing & Care (NIC) Chief Economist and Director of Outreach Beth Burnham Mace told Senior Housing News.

The Amazon effect is something Seattle, Amazon’s hometown, has been grappling with for years. The Emerald City is the fastest growing city in the U.S. this decade, and has grown 18.7% since 2010, Leisure Care SVP, New Business Bre Grubbs said during a panel discussion at NIC’s fall conference in Chicago last month. Leisure Care operates 42 properties across the country.

“What that has brought to our city and its suburbs are a lot young folks,” Grubbs said at the conference. “But also a lot of high-level executives who are white collar, work a lot of hours and dual income where both the son and the daughter or the son- and daughter-in-law, or vice versa, are working.”

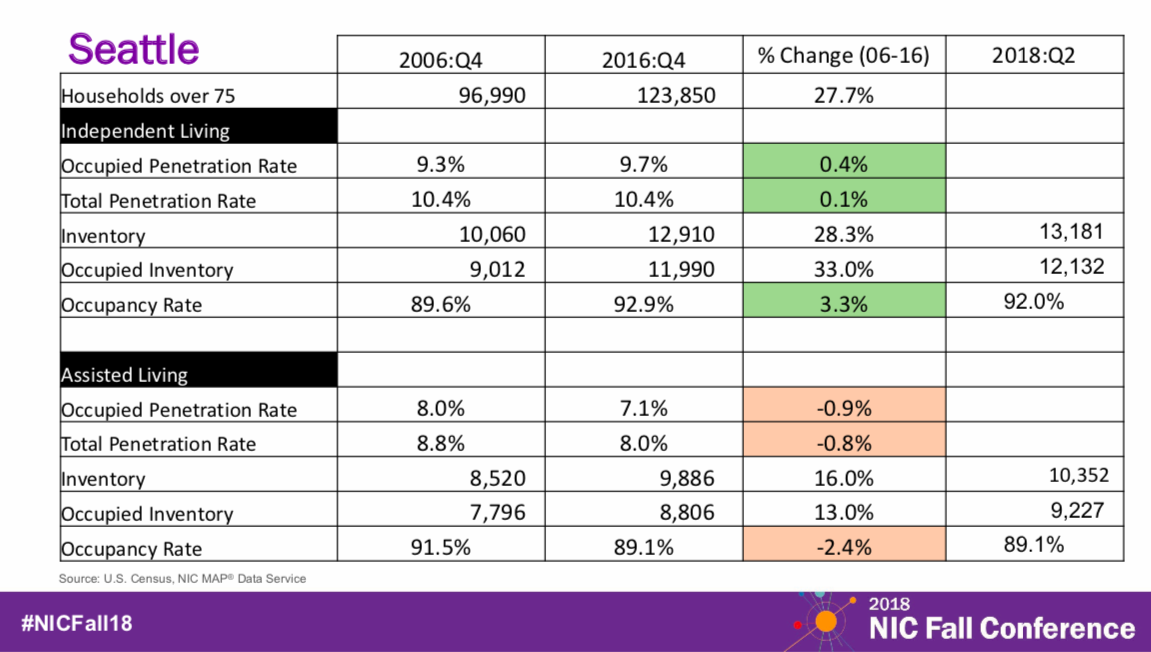

That is having an impact on senior housing, as well. Seattle’s independent living occupancy rate rose from 89.6% in Q4 2006 to 92.9% in Q4 2016. The assisted living occupancy rate declined 2.4% during that same time frame. The Q3 2018 occupancy rates for both are performing better than NIC’s averages.

Courtesy of NIC

Courtesy of NICWith Amazon’s HQ2 announcement, the potential for similar strong senior housing performance exist with New York and D.C. Senior housing operators in both cities would benefit from additional demand, which would put upward pressure on occupancy rates.

“You get an influx of adult, relatively affluent children related to incomes they’re making at Amazon,” Mace said. “Those children tend to bring aging parents into proximity of where they’re living.”

A rising tide lifts all boats

Amazon would bring more than an influx of white-collar jobs to its new HQ2 sites, Mace said.

“There is a multiplier effect of more jobs in ancillary fields because of the demand Amazon will create,” she said.

Amazon’s growth in Seattle is sending residential rents and home values skyrocketing.

“The average home in Seattle gained $54.24 in value per working hour in 2018,” Grubbs said during her NIC fall conference panel. “We’ve seen that level off a little bit the last couple of months.”

The median home price in King County, Washington is $700,000. For Seattle-area seniors, selling their homes with little or no mortgage is almost-unheard of wealth creation, Grubbs said at her panel.

“Our residents may look at it and go, ‘Wow. I have a whole lot more wealth if I sell my home right now,'” she said.

Companies featured in this article:

Amazon, Leisure Care, National Investment Center for Seniors Housing and Care