Active adult is picking up steam as an attractive property type for senior living investors, according to commercial real estate services firm CBRE (NYSE: CBG).

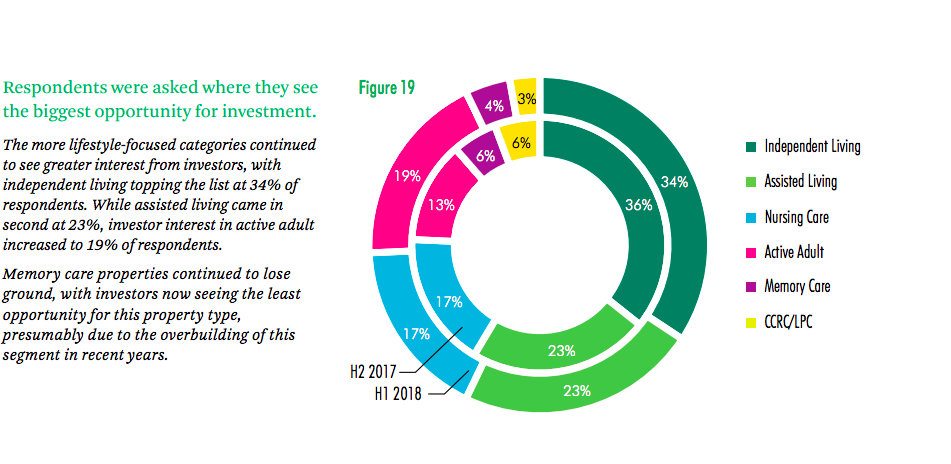

A full 19% of respondents to CBRE’s latest Senior Housing & Care Investor Survey and Trends Report identified active adult as among the “biggest opportunities for investment.” Last year, just 13% of respondents said the same.

The report, released this week, included opinions from 69 different potential investors, including institutional investors, real estate investment trusts (REITs), developers, and private investors.

Overall, the report suggests investors are looking to some creative solutions to help prepare for the incoming “silver tsunami” of baby boomer retirees. Indeed, some in the industry have begun looking at active adult less as simple age-restricted housing, and more as “independent living light.” Scott Stewart, managing partner at Capitol Seniors Housing, even called the product type “the new frontier for senior housing” earlier this year, exemplifying its popularity among major industry players.

But, that doesn’t mean senior housing investors are abandoning the old ways. Investors still see more traditional senior living product types as the most viable investment targets, for example. Independent living took the lead, with 34% of investors saying they saw the biggest opportunity in that space. Assisted living followed, with 23% of respondents flagging the product type as the biggest opportunity. Just 4% of investors saw the biggest opportunity for investment in memory care, and only 3% said the same about continuing care retirement communities (CCRC).

“Investors appear most interested in the lifestyle-focused segments of seniors housing,” CBRE noted in its report. “The active adult segment also is attracting considerable interest.”

On the whole, investor interest in senior housing is still very strong, with roughly two-thirds of the CRBE survey’s respondents expecting to increase the size of their portfolios over the next 12 months. As in years past, investors said they remained concerned about property-level operating costs. Construction activity and rising interest rates also caused some consternation among the survey’s respondents.

Written by Tim Regan