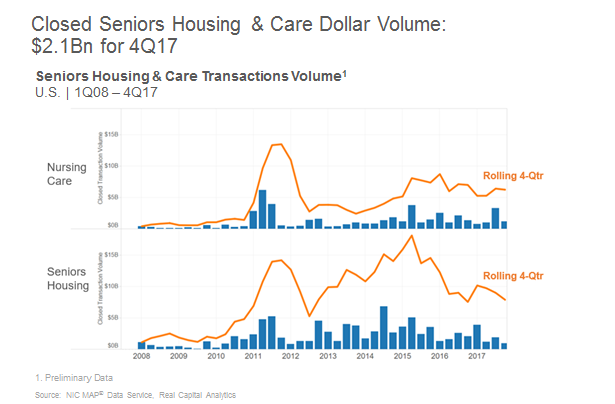

Senior housing and care transaction dollar volume dipped slightly in 2017, according to a blog post by Bill Kauffman, senior principal at the National Investment Center for Seniors Housing & Care (NIC).

Transaction volume for senior housing and care M&A deals clocked in at $14.1 billion in 2017 on a “relatively weak” second and fourth quarter, Kauffman wrote. That’s down 2.8% from the previous year’s transaction volume of $14.5 billion, and down 35.5% from 2015’s total of $21.9 billion.

But senior housing and nursing care deals weren’t on equal footing for the year—$7.9 billion of the total volume in 2017 was in senior housing, which represented a 4.5% increase in volume from 2016. At the same time, nursing care deal volume reached $6.2 billion in 2017, which was down 10.8% when compared with 2016.

Fourth quarter blues

For the fourth quarter of 2017, senior housing and nursing care deal volume hit $2.1 billion, which was down 37.6% from the $3.4 billion recorded in the fourth quarter of 2016. That’s also the lowest quarterly volume since the second quarter of 2013, when senior housing and nursing care deal volume registered $1.7 billion, according to the preliminary data.

Of the $2.1 billion logged in the fourth quarter of 2017, senior housing deals comprised $900 million and nursing care deals made up $1.2 billion—a 50% and 64% decrease, respectively, from the deal volume seen in the third quarter of 2017.

Overall, the total number of deals that closed in 2017 also fell. By the end of the year, 446 senior housing and nursing care deals had closed, 90 of which were portfolio transactions and 356 of which were single-property transactions. That’s a 17% decrease from 2016, when 538 senior housing and nursing care transactions closed overall.

“Not only was the dollar volume the weakest in the fourth quarter, but the number of deals closed was also the smallest of the year, which is highly unusual,” Kauffman wrote. “Sometimes, we’ve seen a very large deal closed within the year that skews the dollar volume in the first, second, or third quarter, but when looking at the absolute number of closed deals, you mostly see the fourth quarter as highly active.”

One reason for those diminished totals could be that buyers were taking a “wait-and-see approach” as the recent tax overhaul came together at the end of 2017.

“Time will tell if deals were delayed into the first quarter of 2018, or perhaps the second quarter,” Kauffman wrote.

Written by Tim Regan