One month into 2021, senior housing occupancy sits at all-time low levels, and it likely will take a year or more for census to recover to pre-pandemic levels.

That’s the take of three industry leaders who participated in the January 29 webinar on the financial outlook for senior housing in 2021, hosted by Senior Housing News and featuring panelists from the National Investment Center for Seniors Housing & Care (NIC), Lument and R.D. Merrill Company.

Other key takeaways include that health care real estate investment trusts (REITs) are expected to be major drivers of senior housing merger and acquisition activity in 2021. Publicly traded REITS will look to dispose of underperforming, non-core assets as the year progresses, and privately-owner REITs are poised to be buyers in this environment.

And as the new year progresses, smaller operators under significant operational pressures will move to exit the business and place their communities on the market, creating attractive opportunities for buyers seeking distressed, value-add product which can then be repositioned to capitalize on middle-market demand.

Closed senior housing transactions decreased significantly in 2020, ending at around $7 billion according to data from Real Capital Analytics, NIC Chief Economist Beth Burnham Mace said. Pricing, meanwhile, has fallen back to levels last seen at the beginning of the most recent building boom in 2014.

The fast start to 2021 is an encouraging sign, but Mace cautions that one month does make a year.

“There is more activity that’s occurring,” she said. “But we don’t know what kind of deals are yet.”

An elongated occupancy rebound

Senior housing occupancy dropped to a record-low 80.7% in the fourth quarter of 2020. And subsequent updates from REITs and operators indicate that occupancy has fallen even further this year.

Occupancy at majority assisted living properties is down 7.5 percentage points since the pandemic started, while occupancy at majority independent living properties experienced a 6.7% drop in that span, Mace said on Friday’s webinar.

Moreover, more than 34,000 units went vacant in the 31 primary markets where NIC collects data during the pandemic; occupancy is now back to late-2017 levels.

“It took seven quarters to gain those 34,000 units,” she said. “We lost them all in three quarters.”

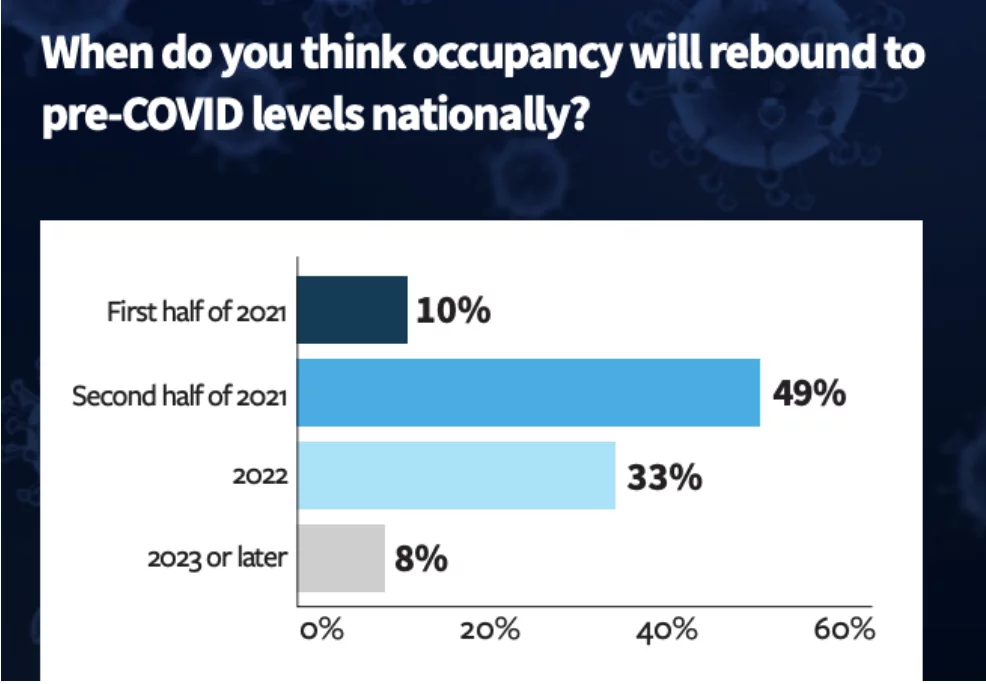

Some analysts believe that occupancy will begin to recover in mid-2021, and 49% of respondents to the 2021 outlook survey from Senior Housing News and Lument said they believe that occupancy will rebound to pre-pandemic levels later this year. But Mace is more pragmatic and is eyeing a late 2022 or early 2023 rebound, she said, stressing that this is her personal view and not an official prediction from NIC.

Before providers can begin to rebuild occupancy, they need to first regain the trust of consumers concerned about the safety of senior housing, after initial news reports conflated outbreaks in nursing homes with the industry.

The other panelists agreed that a more elongated recovery timeline is likely.

Casey Moore, managing director for agency finance at Lument, believes an occupancy rebound will not occur until some time in 2022, citing the expedited dropoff in occupancy last year, the sheer size of the hole in which the industry finds itself, and historic lease-up rates of two to four units per month.

“It’s math; I don’t see how we get that done in the next 8-10 months,” he said.

Vaccines will help restore consumer confidence — “it has the aura of safety” from an operator’s perspective, R.D. Merrill Company President Bill Pettit said — but there are still unknowns about them. Notably, there are questions about whether staff will resist getting the vaccine.

He identified that between 90% to 95% of residents want to get vaccinated, but the percentage is lower among front-line staff and, with unvaccinated team members, the risk of exposure remains inside a community.

Moreover, it is unknown at this time if a universal revaccination for the coronavirus will be required in the fall, and every year thereafter. Until most communities are completely vaccinated, staffs will not be able to reopen the lifestyle components to which residents are accustomed.

“Those challenges don’t go away the first day we get booster [shots],” he said.

The logistics behind vaccinations will keep the industry in a holding pattern throughout much of 2021. And so Pettit also believes that true momentum on occupancy gains will not be seen until 2022 and 2023.

“We’re starting to see at least a bottoming to the bleeding in occupancy that’s occurred,” Pettit said. “We may start to see confidence levels built in the summer … before we start to look at some measures of success.”

Distress expected

Signs of distress emerged last summer among single-site and family-owned operators.

Even if mom-and-pop operators have so far weathered the pandemic, they may decide to exit the business as financial relief dries up, making it harder to make debt service coverage ratios, Mace said.

“It’s very little in terms of the sales that have been distressed, but I think there is more coming,” she said.

When distressed properties are brought to the market, investors will be ready, Moore said. Transaction activity in the fourth quarter of 2020 rebounded after a mid-year low point driven by the pandemic, setting the stage for the brisk Q1 2021 activity and a signal to the markets that an end to the pandemic is on the horizon.

“Participants are getting more comfortable with where we are,” he said.

Lument’s mergers and acquisitions team predicts senior housing deal volume will be active in two subsets: investors hunting for smaller transactions, and larger owners pruning non-core and underperforming assets.

“Some mom and pops are going to throw up the white flag and say, ‘I can’t do this anymore,’” he said.

The pace of distress will accelerate, driven by occupancy pressures and tighter credit restrictions imposed by lenders during the pandemic, Pettit said. The firm is looking at opportunities to acquire properties at solid replacement costs, and is looking beyond its traditional bank partners to institutional investors for opportunities.

“That is appealing,” he said.

Senior housing loan underwriting has tightened significantly over the past year, Greene said. Discussions with Lument’s debt syndications group reveal that banks are lending selectively, depending on how their general portfolios are holding up and specifically on how senior housing performs.

Meanwhile, well-established owner-operators in markets that can truly demonstrate a need for new senior housing are able to secure construction financing, but more equity coverage is needed to complete deals — terms for interim financing and construction loans now come with 65% loan-to-value ratios.

Agency debt is taking a similar approach to managing their portfolios, in order to maintain balance sheets. In a new wrinkle for 2021, Fannie Mae, Freddie Mac and the Department of Housing and Urban Development are focusing on deals with high affordability components, which will receive preference on pricing and waiver considerations.

Finally, private equity is available for the right sponsors, and lenders are looking for yield in their loan terms.

“We have a good barometer on what’s going on,” Moore said.

REITs will drive activity

Real estate investment trusts are expected to contribute to an increase in M&A activity in 2021. Private REITs, in particular, are projected to be buyers this year; 28% of respondents in the SHN/Lument survey suggested that private REITs will pace acquisition activity.

Those REITs might find opportunities from public REITs looking to either sell off non-core underperforming assets or dispose of entire senior housing portfolios, Moore said. Denver-based REIT Healthpeak Properties, notably, cited Covid-19 as one reason the company is pruning its senior housing operating (SHO) and triple-net properties from its total blended portfolio.

As the year progresses, Moore expects other public REITs to follow Healthpeak’s lead in attempts to offset cash flow declines, and as rent reductions in their triple-net assets mount. Other regional operators will consider buying these assets, if the pricing is favorable. Pettit acknowledged that Merrill will capitalize on acquisition opportunities, if the terms are favorable.

“That’s where JVs and partnerships with private REITs can become a vital source of additional capital to achieve some of these transactions that will be necessary to clear some inventory,” he said.

Middle-market demand will increase

Covid-19 will make the demand for middle-market senior housing more acute. The majority of respondents in the SHN/Lument survey see the easiest entry to crack the middle-market in distressed and value-add communities whose values have been adversely impacted by the outbreak, allowing for favorable acquisition to replacement cost ratios.

The operators who do commit to a middle-market strategy will find even more demand as a result of the pandemic, Mace said. Seniors who did not have significant investments in the stock market may find their incomes significantly pressured, or they may have tapped into their nest eggs to support themselves the past year.

“The pandemic has changed the calculus a lot,” she said. “The need is here. The demographics alone suggest the demand pool just gets bigger.”

Merrill Garden made a significant investment into middle-market price points in December 2019, with the acquisition of Blue Harbor. Pettit agrees with Mace’s assessment that the pandemic will force more seniors into the middle-market cohort. He also sees increased investor interest in repositioning older senior housing product to meet the middle-market cohort because these assets can be acquired at well below replacement costs, creating a feeder to new supply.

“I don’t see as much opportunity to develop [housing] for a middle market, because of where development costs have been and what reality is in terms of developing or delivering new buildings at a cost per unit,” he said.

R.D. Merrill is working on an unnamed middle-market brand that Pettit believes can serve as a model. But it will require a combination of a la carte services, particularly tweaks to food service and dining departments where wages and benefits account for 70% of full-time employee hours.

“In today’s environment, you need to critically examine how you provide services to that segment,” he said. “That opens up lots of opportunities when you look at where we believe some of the supply will come.”

Companies featured in this article:

Lument, National Investment Center for Seniors Housing & Care, R.D. Merrill Company