Many developers, builders and other real estate professionals believe that senior housing has not yet hit a bottom due to Covid-19.

That’s according to findings from the mid-year market sentiment survey from RCLCO Real Estate Advisors.

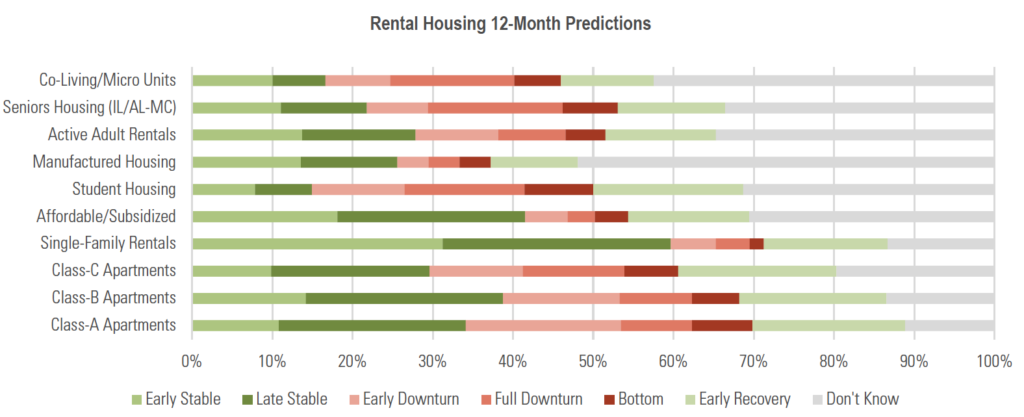

About 22% of respondents said that they believe senior housing — including independent living, assisted living and memory care — is currently in an “early downturn” phase, and 12.5% said they think the sector is in “full downturn.” Only about 8.5% said that senior housing has hit a bottom.

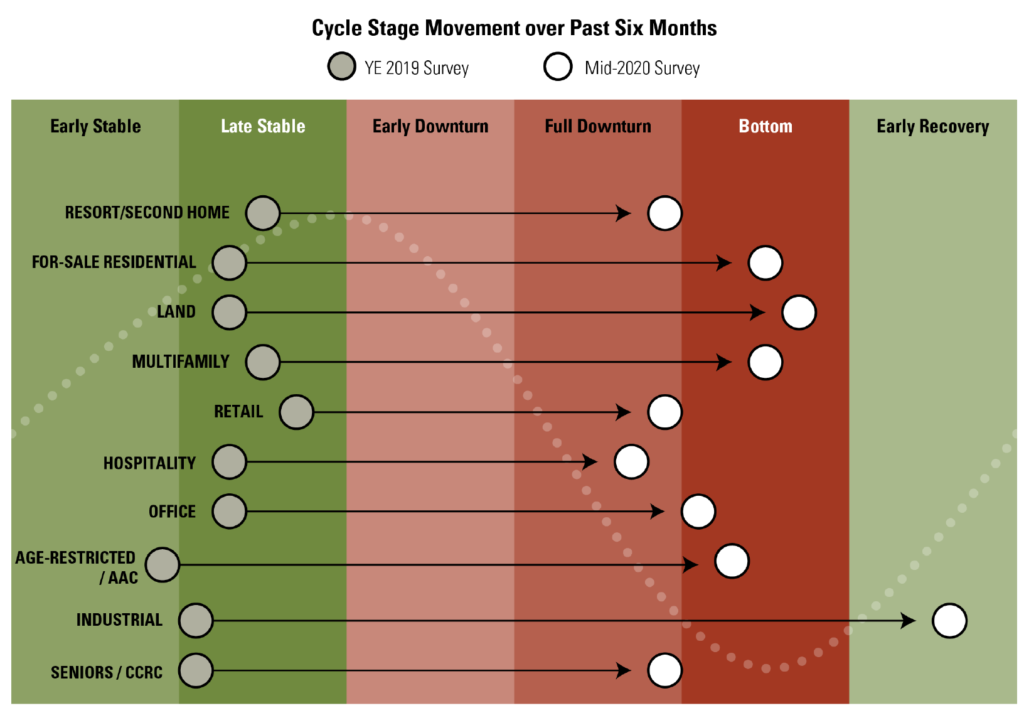

These numbers put senior housing in the same category as other sectors that have been hard-hit by Covid-19, including retail and hospitality.

And when it comes to making predictions about where senior housing will be in 12 months, uncertainty is prevalent. About a third of respondents said “I don’t know” in response to this question, RCLCO Managing Director Brad Hunter told Senior Housing News.

That’s a significantly higher percentage of “I don’t know” responses compared to other types of real estate. The path appears clearer for retail, office, hospitality, residential and industrial, Hunter noted.

The high degree of uncertainty relates to various factors, in Hunter’s view. For one, consumers face a “psychological quandary” as they weigh their potential need for services and socialization against their fear of contagion in these communities. Meanwhile, developers are in the process of rethinking the design and layouts of properties — for example, considering creating smaller clusters of units or “village” type of models to allow smaller groups of people to congregate.

While these questions will only be answered in time, RCLCO’s view is that senior housing will rebound.

“We think this is a needs-based use for real estate, so we think the market will come back,” Hunter said.

In the meantime, though, senior housing could be in for a rough ride. About 60% of survey respondents expect that senior housing will experience moderate or severe impacts due to the economic scenario playing out through the Covid-19 crisis and eventual recovery. Moderate impact was defined as a 5% to 9% loss of net operating income (NOI), prices or valuations, while severe impact was defined as a 10% to 20% reduction.

The ultimate shape of an economic recovery depends on several factors, the report noted — not only on the emergence of potential treatments or a vaccine for Covid-19, but the sustainability of government-fueled economic stimulus. Many real estate professionals are concerned that “things will come unglued” if enhanced unemployment benefits phase out, for example. So far in the pandemic, “surprisingly high rates” of rent collection have persisted in rental housing, including senior housing and active adult.

Overall, RCLCO’s Real Estate Market Index has fallen to its lowest level since the firm began the index at the end of the Great Recession. However, one silver lining may be that fewer than 16% of respondents believe the markets will become “significantly worse” over the next year.