Challenges facing the senior housing sector likely will eat into communities’ net operating income, but this may not deter real estate investment trusts (REITs) from continuing to pursue RIDEA transactions.

“…There has been an ongoing shift among health care REITs to acquire higher quality properties in operating ownership structures, which has had a profound impact on the senior housing landscape,” Green Street Analysts Michael Knott and Andrew Suh wrote in a recently released report on RIDEA. “This shift is not complete and is likely to remain firmly in place in coming years, even as the industry may endure cyclically low NOI [net operating income] growth in ’17 and ’18 due to the impact of new supply and wage pressures.”

RIDEA—the REIT Investment Diversification and Empowerment Act—passed in 2008, allowing senior housing REITs to share in the operating income generated by their owned properties. This increases potential upside in an investment, compared with triple-net leases that simply guarantee escalating rent payments, but it also comes with greater risks should communities’ operations suffer.

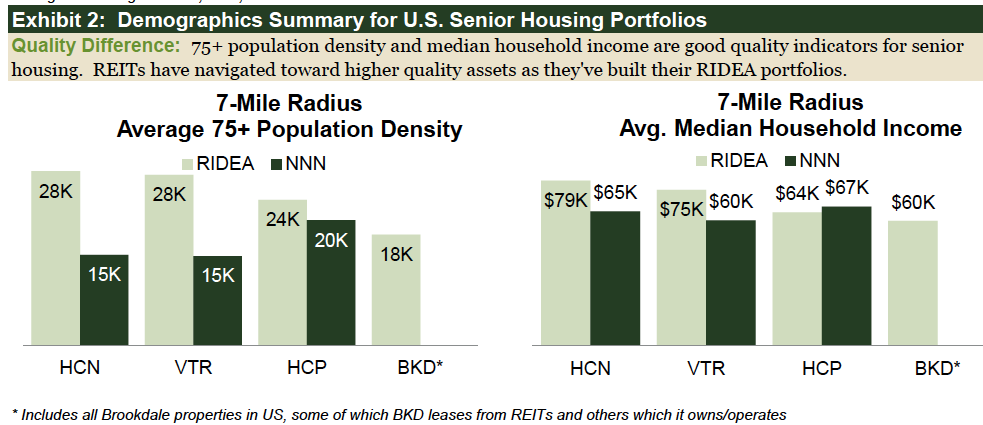

From being nonexistent just eight years ago, RIDEA relationships now account for 60% of the senior housing portfolios of the “big three” REITs, according to the Green Street report. These REITs are Chicago-based Ventas Inc. (NYSE: VTR); Toledo, Ohio-based Welltower (NYSE: HCN); and Irvine, California-based HCP Inc. (NYSE: HCP).

With such a high level of RIDEA exposure, it may seem that the REITs are about to take a hit from the supply and labor issues threatening communities’ operating income. A “rough patch” indeed may be on the horizon, according to Knott and Suh, but that does not mean that there will be a retreat to the safety—perhaps illusory—of traditional triple-net leases.

RIDEA Sitting Pretty?

When analysts questioned them about potential RIDEA risks last August, REIT executives seemed unconcerned.

Those who suspected that this was just cheerleading to reassure shareholders, masking greater concern behind the scenes, may take heart in what Green Street stated in its report.

The REITs generally have been selective in doing RIDEA deals, honing in on high-quality properties in well-chosen markets. They’re betting that “quality wins” in the long-term for senior housing, and even if there are temporary setbacks, the payoff eventually will justify the risks. It’s a proposition that Knott essentially agrees with.

“If I were making the investment decisions and structural decisions, if it were an average or below average location, I would be more comfortable in a triple-net scenario where escalators of 2% to 2.5% capture most of the upside you’d get anyway,” Knott told Senior Housing News. “But for higher-quality properties, there’s better upside over time even at the cost of near-term volatility.”

Cap rates provide some supporting evidence, the Green Street report stated. In senior housing, cap rate spreads across higher- and lower-quality markets are only about 50 basis points, which is not yet as wide as the 150 basis points one could reasonably expect for other property types.

Furthermore, triple-net leases are far from risk-proof.

Take capital expenditures. REITs’ CapEx obligations are significantly higher in RIDEA than in triple-net leases, where the operator bears that burden.

However, operators in a triple-net situation typically invest only the contractually obligated CapEx amount—about 3% of NOI, is Green Street’s best estimate—and this leads to chronic underinvestment in property upkeep and upgrades. When new competition moves into town, that can be a big problem.

Should the operator suddenly find itself challenged, rent coverage could become an issue, forcing the REIT landlord to cut rents and readjust escalators, sell assets—or convert to RIDEA structures. HCP recently undertook a mix of these approaches for Brookdale Senior Living (NYSE: BKD) properties that had hit the danger zone for rent coverages, the Green Street report pointed out.

Continued Activity

Current activity in the marketplace supports the idea that RIDEA remains a popular and even preferred structure, according to Chad Lavender, senior managing director with commercial real estate broker Holliday Fenoglio Fowler.

“I think most owners and operators prefer RIDEA,” Lavender told SHN. “Incentives are aligned 100% to spend CapEx dollars to get the property operating better. If you believe that the country is going to continue to perform well and we’re going to have any type of inflation, you’ll want to share in the NOI growth.”

As for whether supply and cost pressures are raising red flags over RIDEA, Lavender is not seeing much concern, as long as it’s high-quality product being discussed.

However, he does not believe that only prime properties in the highest barrier to entry locations are good candidates for RIDEA.

Even an older building in a market where new supply is coming in could be a promising RIDEA target, in part because new buildings actually can increase demand for the product overall, he said. The key is to carefully evaluate the micro-market to get an accurate picture of the specific forces at work.

Senior housing owners, operators, and investors are more cautious overall these days, but this isn’t necessarily dampening RIDEA enthusiasm, said Ross Sanders, first vice president with real estate services firm CBRE’s National Senior Housing Group.

“I wouldn’t say that there’s people saying, ‘The market’s going down, let’s do triple-net lease,’” he told SHN.

Furthermore, while the RIDEA discussion tends to be focused on the largest public REITs, non-traded REITs also have a strong incentive to prefer this structure, according to Sanders. And he should know, having formerly been the leader of senior housing acquisitions at American Realty Capital Healthcare Trust, a non-traded REIT based in New York City.

RIDEA offers more flexibility than triple-net leases, so if a non-traded REIT wants to consider being acquired by a bigger player as part of an exit strategy, having more RIDEA than triple-net leases on the books is a good play, he said. For example, it makes it easier for a different REIT to install its own preferred operating partners at a property.

Complexity and unfamiliarity may have been a barrier to RIDEA at first, but lenders including Berkadia now have years of experience under their belt and confidence in these transactions, according to Christopher Honn, senior managing director in the company’s Senior Housing Group.

“We do think as a team here that RIDEA structures will be used more in the future, or just regular management agreements, rather than triple-net leases,” said Honn. “Once you understand the structure, the org chart, who has control of which entities and why and how the cash flows work, this is really a good structure from a lender standpoint.”

REITs likely will always maintain some triple-net leases in their portfolios to maintain diversification, and it remains to be seen how RIDEA fares through a cyclical low in the industry, Green Street’s report acknowledged. However, all signs point to RIDEA becoming an even larger share of REITs’ holdings.

“We would fully anticipate that no matter what happens to RIDEA NOI growth in the near term, the inexorable march toward operating ownership structures for senior housing will continue unabated,” Knott and Suh wrote.

Written by Tim Mullaney

Photo Credit: “Rhythm of the Rails,” by j van cise photos, CC BY 2.0

Companies featured in this article:

Berkadia, CBRE, Green Street, HCP, Holliday Fenoglio Fowler, Ventas, Welltower